TORONTO -- Stronger gold prices and the announcement of a new leader at hardware retailer Rona Inc. sent the Toronto stock market higher near midday.

The S&P/TSX composite index increased 23.39 points to 12,805.15, while the TSX Venture Exchange slid 1.46 points to 1,110.32.

The Canadian dollar was down 0.38 of a cent at 97.44 cents US.

The consumer discretionary index rose 0.7 per cent after Rona (TSX:RON) hired Robert Sawyer, a senior executive from the Metro grocery business, to be its next president and chief executive starting next month.

The company's shares were up 4.7 per cent, or 49 cents, to $11.05.

Gold stocks were ahead 0.5 per cent as April bullion lifted $5 to US$1,609.60 an ounce, while May copper rose nearly a cent to US$3.427 a pound.

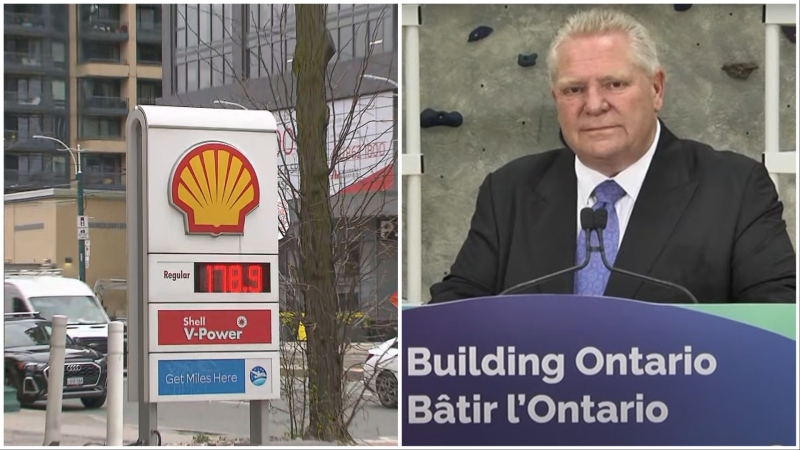

The April crude contract on the New York Mercantile Exchange slipped 25 cents to US$93.49 a barrel.

Meanwhile, U.S. markets got a pop from news that construction started on homes in February at the second-fastest pace in 4 1/2 years. The U.S. Commerce Department says builders broke ground on new homes last month at a seasonally adjusted annual rate of 917,000, up from 910,000 in January.

The Dow Jones industrials rose 23.13 points to 14,475.19, the Nasdaq lifted 0.83 of a point to 3,238.42 while the S&P 500 index was up 0.29 of a point to 1,552.39.

Traders' attention will turn to a two-day meeting of U.S. Federal Reserve that is expected to keep record-low interest rates and other measures in an effort to maintain the momentum of U.S. economic growth. The details will be confirmed through a statement and update on economic forecasts due Wednesday.

But Cyprus was also still on the radar as the tiny island country in the Mediterranean roiled markets this week, announcing hefty taxes on bank accounts over the weekend in a bid to steady its ailing banks and to secure an international bailout. If the vote fails to get through the Cypriot parliament, it could shake confidence in the euro -- Europe's main currency.

Statistics Canada reported that wholesale sales rose by 0.3 per cent in January to $49 billion, mainly due to higher sales in computer and communications equipment and supplies. In volume terms, wholesale sales were up 0.5 per cent for the month.

And manufacturing sales edged down 0.2 per cent in January to $48 billion -- the fourth decline in five months -- impacted by weakness in automotive as well as the petroleum and coal product industry.

Shares in convenience store owner Couche-Tard (TSX:ATD.B) were down after it reported profits rose to $142.5 million, or 75 cents a share, from $86.8 million, or 48 cents, a year earlier. The stock fell nearly 1.4 per cent, or 81 cents, to $54.78.

Lululemon (TSX:LLL) shares took a hit after the company said it has yanked its popular black yoga pants from store shelves because the material was too sheer. The company warned of lower than expected sales because of a shortage of the extraordinarily popular clothing items, which make up make up about 17 per cent of all women's pants and crop pants in its stores.

Shares fell five per cent, or $4.93, to $3.33.

In Europe, the FTSE 100 index of leading British shares was down 0.05 per cent at 6,455 while Germany's DAX fell 0.6 per cent to 7,965 and the CAC-40 in France was 0.9 per cent lower at 3,791.

Earlier, benchmarks in Asia were mostly higher. Japan's Nikkei 225 index jumped two per cent to close at 12,468.23 as the yen dropped against the U.S. dollar. Hong Kong's Hang Seng shed morning gains to fall 0.2 per cent to 22,041.86.