TORONTO -- Since the COVID-19 pandemic began, some banks and lenders have been reviewing credit limits on credit cards and lines of credit and in some cases slashing them without notice.

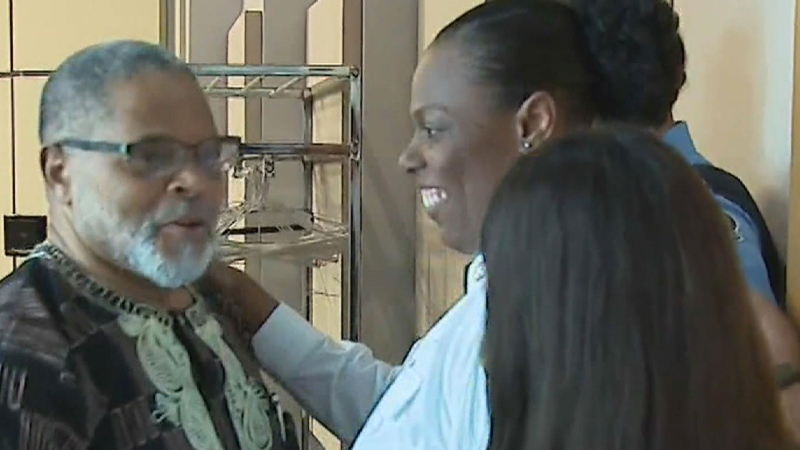

"They just took it away and didn't say a thing to me," said Patrick Garel of Toronto, who had a credit line with his bank for over 25 years.

Garel said he likes to have an additional amount of credit available in case of an emergency and to help his daughter Alicia, who recently finished medical school and is now a front line doctor helping COVID-19 patients.

When he was recently online checking his accounts, he noticed that his credit limit had been slashed by $12,000 from $24,800 to $12,800.

"I don't touch that money. I leave it there just in case I run into problems which during COVID could happen," said Garel.

At the beginning of the pandemic some lenders also lowered limits on credit cards. It's also been happening with credit lines in order for banks to prevent further risk when lending.

Garel is with Scotiabank and complained to his branch and the bank's Ombudsman.

When CTV News Toronto reached out to Scotiabank a spokesperson said they "cannot comment on individual customer matters for privacy reasons."

"However, we can advise that we do regularly review our line of credit accounts and we may make changes to credit limits as permitted under the terms and conditions of our credit agreements for those accounts."

"We remain committed to helping our customers who may be experiencing hardships due to the COVID-19 pandemic and encourage customers to contact their financial advisor or 1-800-4-SCOTIA to discuss their options and to ensure that they have the products and services that best meet their needs," the spokesperson added.

Garel is asking for at least some of his credit line to be re-instated.

"Even if you're not going to put it all back, put back some of it," Garel said.

Garel said when his limit was lowered it also negatively impacted his credit rating.

If you have your credit limit reduced you can appeal, but to keep your credit in good standing, always pay the amount you owe each month, more than the minimum payment if you can and always try to make your payments on time.

Banks could also close down dormant accounts or credit cards that aren't being used. So if you have a card tucked away in a drawer or your wallet, you may want to use it occasionally or it could be cancelled or have its limit reduced.