Too many Toronto pot shops? Why some owners are looking to bail

Like many entrepreneurs, Michael Motala was eager to take part in Canada's newly legal — and hopefully, lucrative — cannabis industry. But after less than a year of running a cannabis store on Toronto's fashionable Queen West neighbourhood, mounting competition and over-regulation are leading him to consider selling his business.

"It was an interesting experience as we were building a new business," said Motala, a Stanford University law professor who co-owns High Street Cannabis Retail with his parents. "But the space is highly restrictive and regulated to the point where it is a comedy of the absurd, if you will, with advertising and the like."

Motala has listed his retail store, which he opened in October 2020, for just under $2 million. Selling cannabis during a pandemic while adhering to a lengthy list of regulations and amid an influx of neighbouring pot stores has whittled down High Street's bottom line.

"A lot of people probably got into this thinking that it would be a gold mine, but unfortunately we're finding out that's not the case," he said. "Even on our street [near the Queen St. West and Bathurst intersection], there's three stores across from us and when we talk some tell me they make five or ten transactions a day. That's pretty much impossible to survive on."

While Ontario took a relatively cautious approach in the early days of legal cannabis stores with two lottery processes that allowed for the opening of 75 pot shops in the first year of legalization, the province has since ramped up its licensing to permit 80 stores a month. It’s also taken a hands-off approach and let the free market to determine which retailers will be successful, a process which has unwittingly created clusters of pot stores in many Toronto neighbourhoods.

There are 859 cannabis stores open in Ontario today, 163 of which are located in downtown Toronto according to the Alcohol and Gaming Commission of Ontario, the regulatory body that oversees legal pot shops in the province. If you include some of Toronto's boroughs outside of the downtown core such as East York and Etobicoke, there are 267 legal and licensed pot shops open in Canada's biggest city.

Lucas McCann, chief scientific officer at CannDelta Inc., a cannabis consultancy that has helped open about 80 stores in Ontario, said retailers in the province are facing heavy competition not only from neighbouring shops, but also from the provincially-owned Ontario Cannabis Store, which also operates the wholesale business that supplies their stores. He added some stores may be up for due to owners who got into cannabis retail to flip their outlets for a quick buck.

"There's a sense that it's better to throw in the towel now rather than wait down the road and not get what they presumed to be under market value for their store," McCann said in a phone interview.

A vendor displays marijuana for sale during the 4-20 annual marijuana celebration in Vancouver on April 20, 2018. (THE CANADIAN PRESS/Darryl Dyck)

A vendor displays marijuana for sale during the 4-20 annual marijuana celebration in Vancouver on April 20, 2018. (THE CANADIAN PRESS/Darryl Dyck)

Kiaro Brands Inc. Chief Executive Daniel Petrov told BNN Bloomberg that he observed the Ontario market for a few years before acquiring seven Hemisphere Cannabis stores from former Second Cup operator Aegis Brands Inc. for just under $10 million in a stock deal. Petrov said the asking price for some of the first pot stores in Toronto was as high as $8 million per store and that he decided to wait on the sidelines after seeing how valuations in other mature markets like Colorado plummeted following the first few years of operation.

"We've said this internally for a long time, but once the haze wears off people are going to realize that you're running a retail business and it's very competitive, especially on a large scale," Petrov said. "We took our time to get in Ontario but it's going to be a bloodbath here so you have to operate on traditional metrics."

A vendor displays marijuana for sale during the 4-20 annual marijuana celebration in Vancouver on April 20, 2018. (THE CANADIAN PRESS/Darryl Dyck)

While it is unclear how many cannabis stores are up for sale, public listings on Realtor.ca show six shops in Toronto, two in Alberta, and another six in B.C. are on the block. However, the vast majority of retailer transactions are handled privately according to High Tide Inc. Chief Executive Officer Raj Grover.

"Sometimes I get [inquiries] daily, sometimes I get five requests a week, and these are all inbound. I don't have to go out and prospect for acquisitions," Grover said.

"But we don't want to just buy stores or buy companies for the sake of it. We want to buy them because they're financially strong businesses and we can improve them."

Motala still isn't fully sure if his family will sell High Street, but wants his parents to retire comfortably when they still can. If he sells, he wants to sell the store to another independently-minded operator, stating that the market is primed for larger retailers with deeper pockets that can weather future financial storms.

"My worry is that it's going to turn into the Beer Store model, where you have two or three dominant retail chains and that's it," he said. "I don't think the government put enough protection in there for the little guys."

CTVNews.ca Top Stories

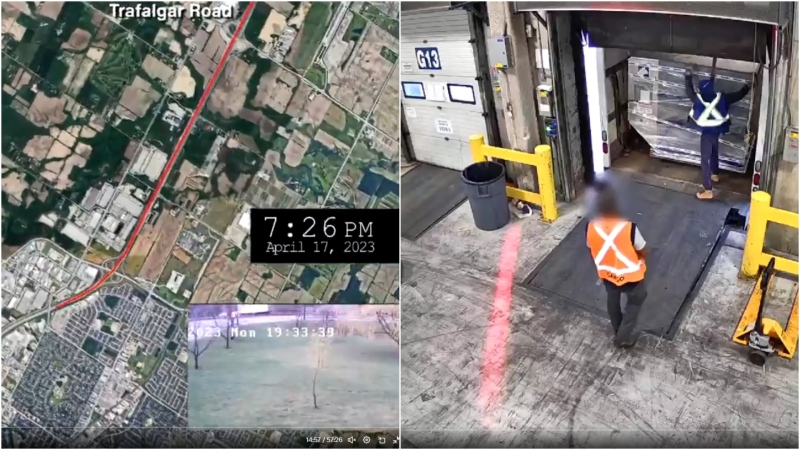

'They needed people inside Air Canada:' Police announce arrests in Pearson gold heist

Police say one former and one current employee of Air Canada are among the nine suspects that are facing charges in connection with the gold heist at Pearson International Airport last year.

House admonishes ArriveCan contractor in rare parliamentary show of power

MPs enacted an extraordinary, rarely used parliamentary power on Wednesday, summonsing an ArriveCan contractor to appear before the House of Commons where he was admonished publicly and forced to provide answers to the questions MPs said he'd previously evaded.

Leafs star Auston Matthews finishes season with 69 goals

Auston Matthews won't be joining the NHL's 70-goal club this season.

Trump lawyers say Stormy Daniels refused subpoena outside a Brooklyn bar, papers left 'at her feet'

Donald Trump's legal team says it tried serving Stormy Daniels a subpoena as she arrived for an event at a bar in Brooklyn last month, but the porn actor, who is expected to be a witness at the former president's criminal trial, refused to take it and walked away.

Why drivers in Eastern Canada could see big gas price spikes, and other Canadians won't

Drivers in Eastern Canada face a big increase in gas prices because of various factors, especially the higher cost of the summer blend, industry analysts say.

Doug Ford calls on Ontario Speaker to reverse Queen's Park keffiyeh ban

Ontario Premier Doug Ford is calling on Speaker Ted Arnott to reverse a ban on keffiyehs at Queen's Park, describing the move as “needlessly” divisive.

'A living nightmare': Winnipeg woman sentenced following campaign of harassment against man after online date

A Winnipeg woman was sentenced to house arrest after a single date with a man she met online culminated in her harassing him for years, and spurred false allegations which resulted in the innocent man being arrested three times.

Woman who pressured boyfriend to kill his ex in 2000s granted absences from prison

A woman who pressured her boyfriend into killing his teenage ex more than a decade ago will be allowed to leave prison for weeks at a time.

Customers disappointed after email listing $60K Tim Hortons prize sent in error

Several Tim Horton’s customers are feeling great disappointment after being told by the company that an email stating they won a boat worth nearly $60,000 was sent in error.