This is what Ontarians are saying about being able to afford a house

Many Toronto families and professionals with stable salaries are increasingly finding home ownership out of reach, some sharing their struggles to make buying a house a reality.

The problem is highlighted by CTV News’ Chief Financial Commentator, who says making $75,000 a year isn’t enough to buy a home, possibly not even a condo in Toronto.

CTV News Toronto spoke with renters in the Yonge and Eglinton area.

Zoe Keefer, 32, is expecting her first child in January. Keefer and her husband moved from the west-end to Yonge and Eglinton to get more space in their rental — and would like to own a home, but the prospect feels out of reach.

“Each bedroom you need adds an extra $1,000 [to the rent] often, and I was just thinking about really wanting a home with a few bedrooms, maybe even a basement, just so that you can fit your family and enjoy life. That just feels very unattainable.”

Keefer said they are both well educated and expects their income to hover around $150,000.

Will ever be possible to own a home in Toronto if you're a single-income earner making around $75,000? (Pexels)

Will ever be possible to own a home in Toronto if you're a single-income earner making around $75,000? (Pexels)

“I think for us, because it’s been so many years of paying really exorbitant rent prices, our disposable income is not enough to generate a down payment and our parents aren’t in a position to give us a gift,” she said.

Keefer said she has a lot of friends who had babies in the past year and started families in one-bedroom apartments. She wants to stay in the city, but is also thinking about the fact it may not be doable down the road, if her family need another bedroom, for another child.

Mark Jenkie is in mid-30s, works full-time in the medical education admin field and is going to school part time. He’s trying to save and make more money.

He said he loves living in the city but it’s also frustrating, upsetting and daunting to live in a city where working people with good jobs can’t get into the market.

“I’ve lived in the same apartment for like 9 years,” he said. “I’m not making $75,000 a year and I cannot afford it and it’s not even in my grasp. I think if you’re not part of dual income situation it’s almost impossible to own anything in Toronto.”

Single mom of four Stephanie Douglas said owning a home or condo is also unattainable as her salary goes toward living ‘day-by-day’. She makes around $50,000 a year.

“I would like to give them that opportunity but the prices of houses keeps rising, I can’t afford that,” said Douglas.

“My hope is that my children will do better than I do, because I can’t do it for them. Hopefully they can do it for themselves.”

STRUGGLING TO OWN OUTSIDE TORONTO

Even outside of Toronto, some professionals like Steven Gill, 30, in Oshawa are struggling to figure out a way to own a home.

Gill works for the municipality and teaches at Durham College and makes more than $75,000 a year.

“I’m having a trouble getting a down payment. That’s where I’m stuck.”

He said he didn’t expect prices in the east GTA to increase as much as they have or even think about having to buy a place further east or north to make owning possible.

He would like to see banks view renters making regular payments differently.

“I have proof that I’ve never missed that payment, I don’t see why banks wouldn’t take a chance on a customer like that, when they lock me in a mortgage. Lock me in as a customer for 30-35 years, whatever it might be,” said Gill.

HOW TO MAKE IT HAPPEN

One woman also in her 30s, told CTV News Toronto she and her husband purchased a house in Toronto earlier this year.

She said they managed to buy after each owning their own condos and using the money from their sales to purchase the house. She said starting the process now to own the home would be difficult.

Lovett-Reid said to buy a $1 million home people need about $200, 000 of income per year.

CTVNews.ca Top Stories

RCMP uncovers plot to sell drones and equipment to Libya

The RCMP says it has uncovered a plot by two men in Montreal to sell Chinese drones and military equipment to Libya illegally.

Demonstrators kicked out of Ontario legislature for disruption after failed keffiyeh vote

A group of demonstrators were kicked out of the legislature after a second NDP motion calling for unanimous consent to reverse a ban on the keffiyeh failed to pass.

Tom Mulcair: Park littered with trash after 'pilot project' is perfect symbol of Trudeau governance

Former NDP leader Tom Mulcair says that what's happening now in a trash-littered federal park in Quebec is a perfect metaphor for how the Trudeau government runs things.

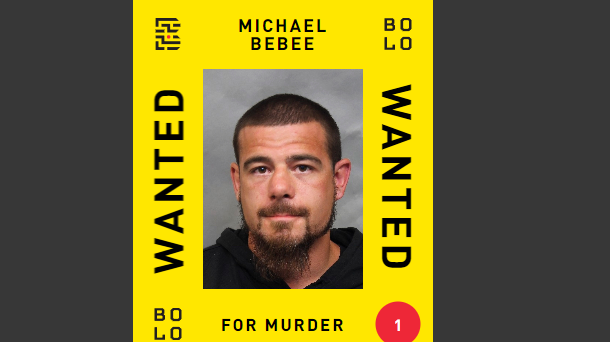

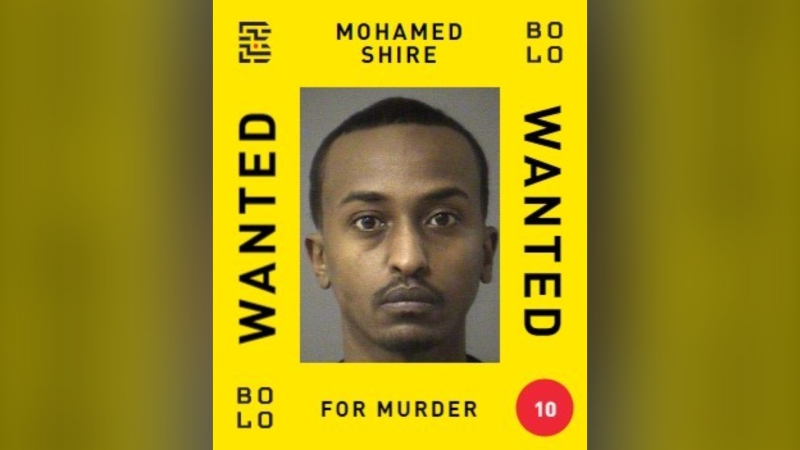

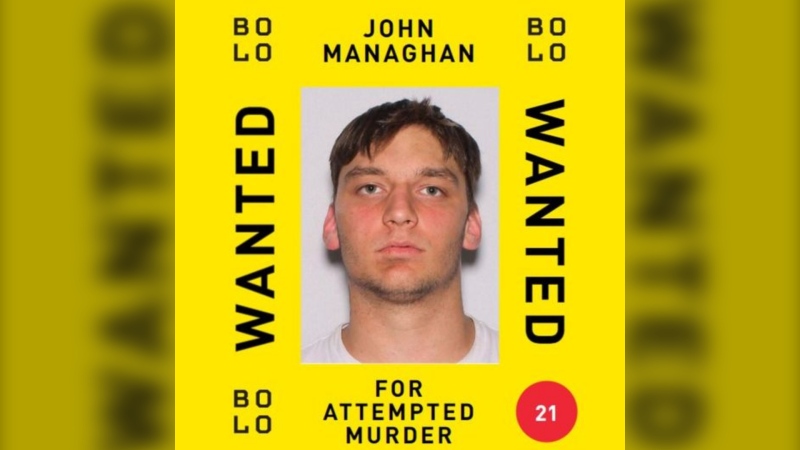

Man wanted in connection with deadly shooting in Toronto tops list of most wanted fugitives in Canada

A 35-year-old man wanted in connection with the murder of Toronto resident 29-year-old Sharmar Powell-Flowers nine months ago has topped the list of the BOLO program’s 25 most wanted fugitives across Canada, police announced Tuesday.

Doctors ask Liberal government to reconsider capital gains tax change

The Canadian Medical Association is asking the federal government to reconsider its proposed changes to capital gains taxation, arguing it will affect doctors' retirement savings.

Keeping these exotic pets is 'cruel' and 'dangerous,' Canadian animal advocates say

Canadian pet owners are finding companionship beyond dogs and cats. Tigers, alligators, scorpions and tarantulas are among some of the exotic pets they are keeping in private homes, which pose risks to public safety and animal welfare, advocates say.

Thieves use stolen forklift to rip cash machine out of U.K. bank

Police in the U.K. are searching for a group of suspects seen on video using a forklift to steal a cash machine from a bank.

'There was a lot of black smoke': Crane operator sounds alarm while trapped during highrise fire in Halifax

A tower crane operator alerted emergency crews after noticing a fire on a construction site in Halifax Tuesday morning.

Cherry blossoms blooming in Canada: Here's what to know

There is a swaying sea of colour in some cities across Canada, and it's a sure sign of spring: cherry blossoms are in bloom.