Ontario's staycation tax credit is now in effect and this is how it works

Ontario's staycation tax credit for 2022 is now in effect.

Anyone planning a getaway within the province in 2022 could be eligible for a tax refund under the new "Ontario Staycation Tax Credit" program.

Ontarians can get a 20 per cent personal income tax credit on eligible accommodation between Jan. 1 and Dec. 31, up to a maximum of $1,000 for an individual and $2,000 for a family, for a maximum credit of $200 or $400 respectively.

Ontario residents can apply for this refundable credit when they file their 2022 personal tax returns and benefit even if they do not owe any tax.

Ontarians should expect to see a mix of wet and warm weather this summer. (The Canadian Press)

Ontarians should expect to see a mix of wet and warm weather this summer. (The Canadian Press)

According to the government, an eligible accommodation expense has to be:

- For a stay of less than a month at an eligible accommodation such as a hotel, motel, resort, lodge, bed-and-breakfast establishment, cottage or campground in Ontario

- For a stay between Jan. 1 and Dec. 31 of 2022

- Incurred for leisure

- Paid by the Ontario tax filer, their spouse or common-law partner, or their eligible child, as set out on a detailed receipt

- Not reimbursed to the tax filer, their spouse or common-law partner, or their eligible child, by any person, including by a friend or an employer

- Subject to Goods and Services Tax (GST)/Harmonized Sales Tax (HST), as set out on a detailed receipt.

The government said this tax credit will help the tourism and hospitality sectors recover and encourage Ontarians to explore the province.

The credit could provide an estimated $270 million to support over one-and-a-half million families to further discover Ontario, the government said.

CTVNews.ca Top Stories

Flights divert around western Iran as one report claims explosions heard near Isfahan

Commercial flights began diverting their routes early Friday morning over western Iran without explanation as one semiofficial news agency in the Islamic Republic claimed there had been 'explosions' heard over the city of Isfahan.

American millionaire Jonathan Lehrer denied bail after being charged with killing Canadian couple

American millionaire Jonathan Lehrer, one of two men charged in the killings of a Canadian couple in Dominica, has been denied bail.

Nearly half of China's major cities are sinking, researchers say

Nearly half of China's major cities are suffering 'moderate to severe' levels of subsidence, putting millions at risk of flooding especially as sea levels rise.

Prince Harry formally confirms he is now a U.S. resident

Prince Harry, the son of King Charles III and fifth in line to the British throne, has formally confirmed he is now a U.S. resident.

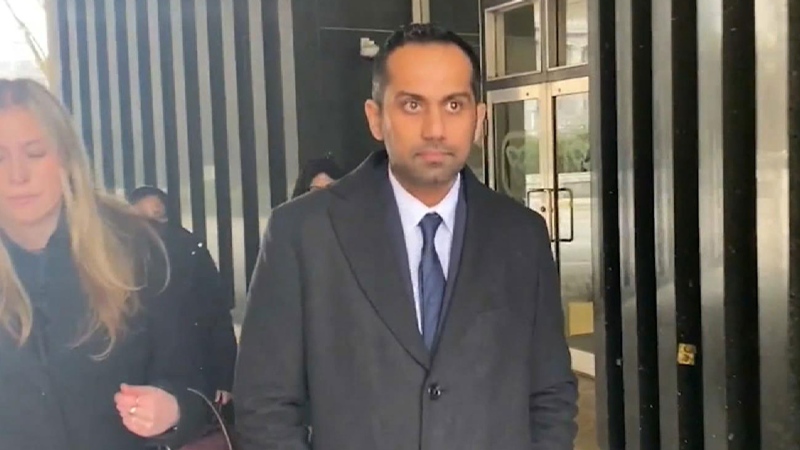

Judge says 'no evidence fully supports' murder case against Umar Zameer as jury starts deliberations

The judge presiding over the trial of a man accused of fatally running over a Toronto police officer is telling jurors the possible verdicts they may reach based on the evidence in the case.

Health Canada to change sperm donor screening rules for men who have sex with men

Health Canada will change its longstanding policy restricting gay and bisexual men from donating to sperm banks in Canada, CTV News has learned. The federal health agency has adopted a revised directive removing the ban on gay, bisexual and other men who have sex with men, effective May 8.

Colin Jost names one celebrity who is great at hosting 'Saturday Night Live'

Colin Jost, who co-anchors Saturday Night Live's 'Weekend Update,' revealed who he thinks is one of the best hosts on the show.

Sports columnist apologizes for 'oafish' comments directed at Caitlin Clark. The controversy isn't over

A male columnist has apologized for a cringeworthy moment during former University of Iowa superstar and college basketball's highest scorer Caitlin Clark's first news conference as an Indiana Fever player.

'Shopaholic' author Sophie Kinsella reveals brain cancer diagnosis

Sophie Kinsella, the best-selling author behind the 'Shopaholic' book series, has revealed that she is receiving treatment for brain cancer.