Ontario millennials need to save for over 20 years for down payment on a home: report

A real estate sign is displayed in front of a house in the Riverdale area of Toronto on Wednesday, September 29, 2021. THE CANADIAN PRESS/Evan Buhle

A real estate sign is displayed in front of a house in the Riverdale area of Toronto on Wednesday, September 29, 2021. THE CANADIAN PRESS/Evan Buhle

A new report shows house prices need to drop by more than $500,000 for millennials to be able to afford a home in Ontario.

Generation Squeeze, a charitable organization fighting for generational fairness in the country, recently released a 56-page reported called “Straddling the Gap 2022,” which looks at the disparity between home prices and earnings across the country.

The study analyzes what Canada’s “primary goal” should be for home prices by looking at the gap between earnings and average home prices from 1976 until 2021, which was the last year available to procure data from the Canadian Real Estate Association (CREA).

After analyzing CREA’s data and comparing it to Statistics Canada’s data for annual income, the report concludes prices should stall “for many years ahead – or even continue to fall moderately.”

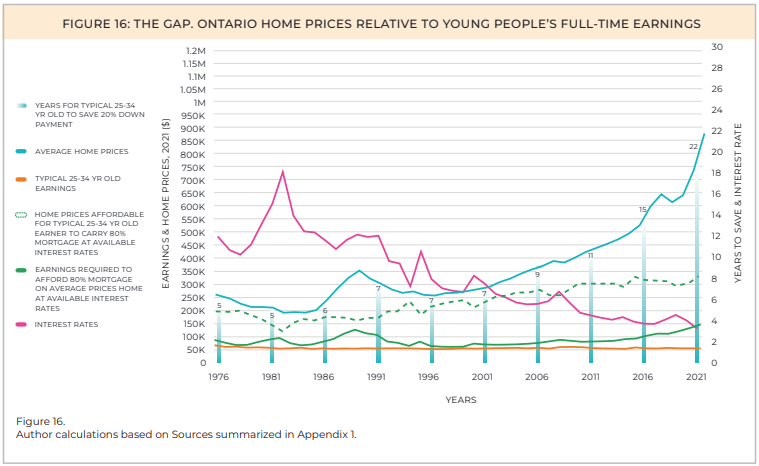

“The number of years of work required to save [for] a 20 [per cent] down payment on average priced homes has grown in alarming ways in many regions,” the report reads.

Across Ontario, average home prices were just shy of $900,000 last year.

Meanwhile, average income of Ontarians between the ages of 25 and 34 years has stayed nearly the same for decades, lingering at an average of roughly $50,000 a year. According to the latest data from StatsCan, the yearly income was $50,800 in 2020.

In order for millennials to buy a home in the province, the report says average home prices need to drop by $530,000, more than 60 per cent of the market value last year, for them to afford a mortgage that covers 80 per cent of the value.

Or, Ontario millennials will need to be earning $137,000 a year, which is roughly $85,000 more than what they are currently making on average.

A graph of Ontario's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

A graph of Ontario's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

“It takes 22 years of full-time work for the typical young person to save a 20 [per cent] down payment on an average priced home,” the report reads, which they say is 17 years longer than when “today’s aging population” were their age. The report did not clarify what age groups fall under this definition.

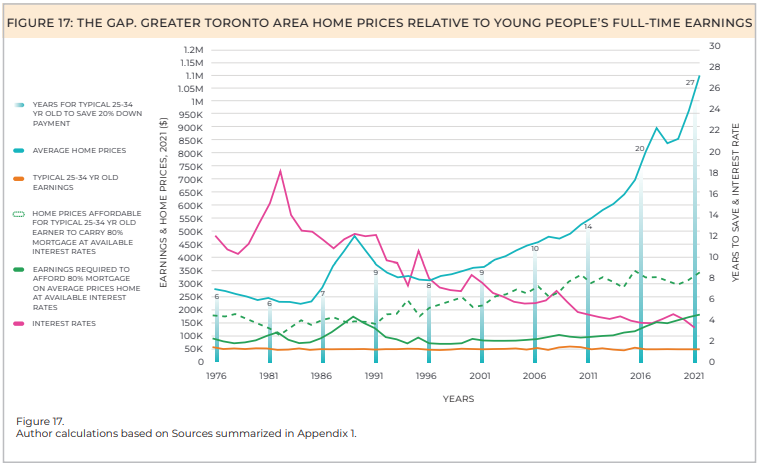

The lack of affordability in the Greater Toronto Area (GTA) is even steeper.

Those who have their sights set on owning a home in the GTA will have to save for an average of 27 years to make the same downpayment on an average-priced home. That is 10 years longer compared to the average amount of time across Canada.

Average annual incomes have remained at around $50,000 in the region, with StatsCan revealing 25 to 34-year-olds in the GTA raked in an average of $51,600 in 2020.

Meanwhile, average home prices in the region have soared to $1.1 million.

According to the report, these prices will have to fall by more than $750,000 for this age group to afford a mortgage that covers 80 per cent of the home’s value at current interest rates.

A graph of the GTA's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

A graph of the GTA's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

“Or typical full-time earnings would need to increase to $172,000/year – more than triple current levels,” the report notes.

Rent is also steep for those who cannot afford to buy, as the report notes it costs $20,148 a year for a two-bedroom apartment in the GTA in 2021.

With how much millennials make a year on average, rent takes up about 40 per cent of their income.

House prices in the GTA, however, are expected to drop slightly next year.

According to Re/Max Canada’s housing market outlook for 2023, prices are expected to fall by nearly 12 per cent to an average of just over $1 million.

CTVNews.ca Top Stories

Health Canada to change sperm donor screening rules for men who have sex with men

Health Canada will change its longstanding policy restricting gay and bisexual men from donating to sperm banks in Canada, CTV News has learned. The federal health agency has adopted a revised directive removing the ban on gay, bisexual and other men who have sex with men, effective May 8.

American millionaire Jonathan Lehrer denied bail after being charged with killing Canadian couple

American millionaire Jonathan Lehrer, one of two men charged in the killings of a Canadian couple in Dominica, has been denied bail.

LeBlanc says he plans to run in next election, under Trudeau's leadership

Cabinet minister Dominic LeBlanc says he plans to run in the next election as a candidate under Prime Minister Justin Trudeau's leadership, amid questions about his rumoured interest in succeeding his longtime friend for the top job.

U.S. vetoes a widely supported UN resolution backing full membership for Palestine

The United States has vetoed a widely backed UN resolution that would have paved the way for full United Nations membership for the state of Palestine.

Sports columnist apologizes for 'oafish' comments directed at Caitlin Clark. The controversy isn’t over

A male columnist has apologized for a cringeworthy moment during former University of Iowa superstar and college basketball’s highest scorer Caitlin Clark’s first news conference as an Indiana Fever player.

Bayer recalls hydraSense baby product over 'potential contamination'

Bayer announced Thursday it is recalling two lots of its hydraSense Baby Nasal Care Easydose due to a potential contamination.

N.L. gardening store revives 19th century seed-packing machine

Technology from the 19th century has been brought out of retirement at a Newfoundland gardening store, as staff look for all the help they can get to fill orders during a busy season.

Cat found on Toronto Pearson airport runway 3 days after going missing

Kevin the cat has been reunited with his family after enduring a harrowing three-day ordeal while lost at Toronto Pearson International Airport earlier this week.

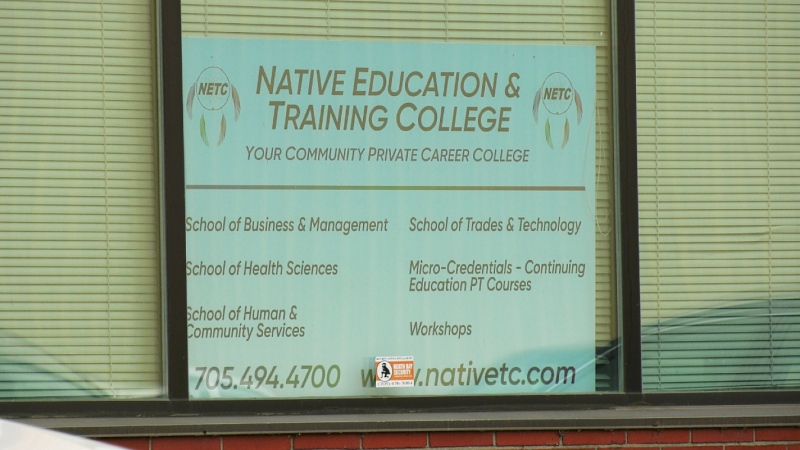

Grandparent scam suspects had ties to Italian organized crime, police allege

A group of suspects that allegedly defrauded seniors across Ontario and other parts of Canada using a so-called emergency grandparent scam appear to have ties to 'Italian traditional organized crime,' according to an investigator involved in the OPP-led probe.