Ontario millennials need to save for over 20 years for down payment on a home: report

A real estate sign is displayed in front of a house in the Riverdale area of Toronto on Wednesday, September 29, 2021. THE CANADIAN PRESS/Evan Buhle

A real estate sign is displayed in front of a house in the Riverdale area of Toronto on Wednesday, September 29, 2021. THE CANADIAN PRESS/Evan Buhle

A new report shows house prices need to drop by more than $500,000 for millennials to be able to afford a home in Ontario.

Generation Squeeze, a charitable organization fighting for generational fairness in the country, recently released a 56-page reported called “Straddling the Gap 2022,” which looks at the disparity between home prices and earnings across the country.

The study analyzes what Canada’s “primary goal” should be for home prices by looking at the gap between earnings and average home prices from 1976 until 2021, which was the last year available to procure data from the Canadian Real Estate Association (CREA).

After analyzing CREA’s data and comparing it to Statistics Canada’s data for annual income, the report concludes prices should stall “for many years ahead – or even continue to fall moderately.”

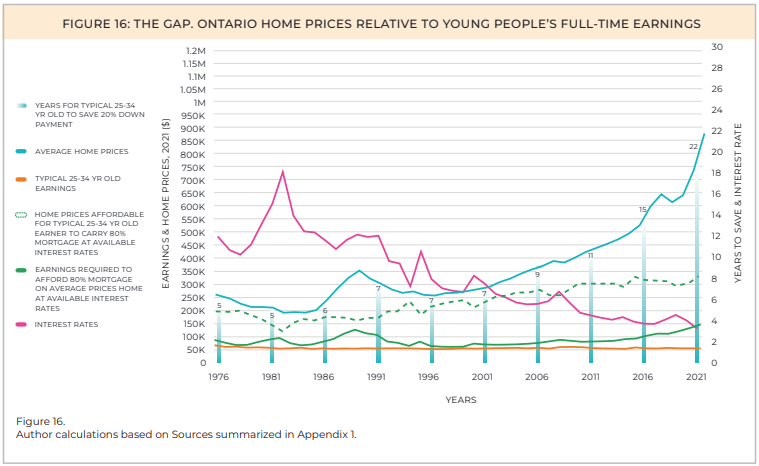

“The number of years of work required to save [for] a 20 [per cent] down payment on average priced homes has grown in alarming ways in many regions,” the report reads.

Across Ontario, average home prices were just shy of $900,000 last year.

Meanwhile, average income of Ontarians between the ages of 25 and 34 years has stayed nearly the same for decades, lingering at an average of roughly $50,000 a year. According to the latest data from StatsCan, the yearly income was $50,800 in 2020.

In order for millennials to buy a home in the province, the report says average home prices need to drop by $530,000, more than 60 per cent of the market value last year, for them to afford a mortgage that covers 80 per cent of the value.

Or, Ontario millennials will need to be earning $137,000 a year, which is roughly $85,000 more than what they are currently making on average.

A graph of Ontario's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

A graph of Ontario's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

“It takes 22 years of full-time work for the typical young person to save a 20 [per cent] down payment on an average priced home,” the report reads, which they say is 17 years longer than when “today’s aging population” were their age. The report did not clarify what age groups fall under this definition.

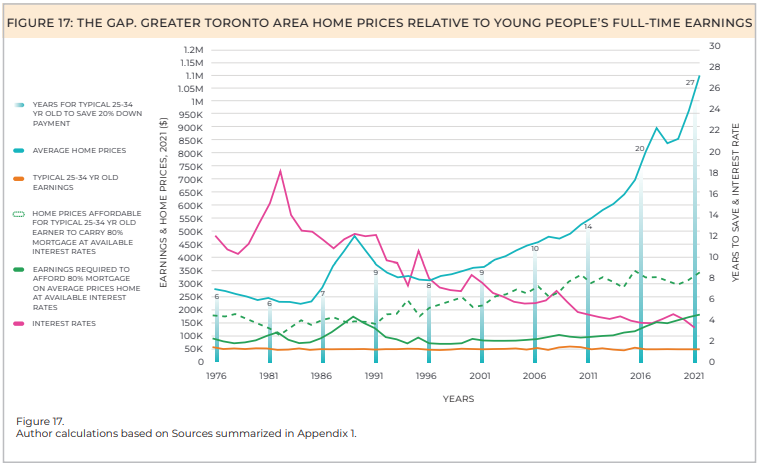

The lack of affordability in the Greater Toronto Area (GTA) is even steeper.

Those who have their sights set on owning a home in the GTA will have to save for an average of 27 years to make the same downpayment on an average-priced home. That is 10 years longer compared to the average amount of time across Canada.

Average annual incomes have remained at around $50,000 in the region, with StatsCan revealing 25 to 34-year-olds in the GTA raked in an average of $51,600 in 2020.

Meanwhile, average home prices in the region have soared to $1.1 million.

According to the report, these prices will have to fall by more than $750,000 for this age group to afford a mortgage that covers 80 per cent of the home’s value at current interest rates.

A graph of the GTA's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

A graph of the GTA's home prices relative to 25-to-34-year-olds full-time earnings. (Generation Squeeze)

“Or typical full-time earnings would need to increase to $172,000/year – more than triple current levels,” the report notes.

Rent is also steep for those who cannot afford to buy, as the report notes it costs $20,148 a year for a two-bedroom apartment in the GTA in 2021.

With how much millennials make a year on average, rent takes up about 40 per cent of their income.

House prices in the GTA, however, are expected to drop slightly next year.

According to Re/Max Canada’s housing market outlook for 2023, prices are expected to fall by nearly 12 per cent to an average of just over $1 million.

CTVNews.ca Top Stories

Doctors say capital gains tax changes will jeopardize their retirement. Is that true?

The Canadian Medical Association asserts the Liberals' proposed changes to capital gains taxation will put doctors' retirement savings in jeopardy, but some financial experts insist incorporated professionals are not as doomed as they say they are.

Something in the water? Canadian family latest to spot elusive 'Loch Ness Monster'

For centuries, people have wondered what, if anything, might be lurking beneath the surface of Loch Ness in Scotland. When Canadian couple Parry Malm and Shannon Wiseman visited the Scottish highlands earlier this month with their two children, they didn’t expect to become part of the mystery.

Fair in Ontario, flurries in Labrador: Weather systems make for an erratic spring

It's no secret that spring can be a tumultuous time for Canadian weather, and as an unseasonably mild El Nino winter gives way to summer, there's bound to be a few swings in temperature that seem out of the ordinary. From Ontario to the Atlantic, though, this week is about to feel a little erratic.

What do weight loss drugs mean for a diet industry built on eating less and exercising more?

Recent injected drugs like Wegovy and its predecessor, the diabetes medication Ozempic, are reshaping the health and fitness industries.

He replaced Mickey Mantle. Now baseball's oldest living major leaguer is turning 100

The oldest living former major leaguer, Art Schallock turns 100 on Thursday and is being celebrated in the Bay Area and beyond as the milestone approaches.

What a urologist wants you to know about male infertility

When opposite sex couples are trying and failing to get pregnant, the attention often focuses on the woman. That’s not always the case.

'It was instant karma': Viral video captures failed theft attempt in Nanaimo, B.C.

Mounties in Nanaimo, B.C., say two late-night revellers are lucky their allegedly drunken antics weren't reported to police after security cameras captured the men trying to steal a heavy sign from a downtown business.

Bank of Canada officials split on when to start cutting interest rates

Members of the Bank of Canada's governing council were split on how long the central bank should wait before it starts cutting interest rates when they met earlier this month.

Quebec nurse had to clean up after husband's death in Montreal hospital

On a night she should have been mourning, a nurse from Quebec's Laurentians region says she was forced to clean up her husband after he died at a hospital in Montreal.