Ontario insurer demands man maimed in hit-and-run pay care worker less than minimum wage

A Toronto man who was grievously injured in a hit-and-run crash last year says he can’t believe an insurance company is withholding benefits until he finds someone who will care for him for less than minimum wage.

Alan Weymouth says he’s now being taken for a ride by the insurer of that driver, who was charged criminally in the case, thanks to what his lawyer says is a misinterpretation of Ontario rules.

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

But that misinterpretation is becoming so common it could affect hundreds of people injured in crashes per year and is forcing some home-care providers to scale back their businesses, observers say.

“It’s sad. They shouldn’t be able to get away with treating people like that,” Weymouth said in an interview with CTV News.

“None of this is my fault, and I don’t understand why I’m being denied. My life will never be the same because of this accident, all because of one person and now I’ve got to fight to get everything,” he said.

Weymouth was riding his e-bike on Wilson Avenue in March 2022 when he was hit by a driver of a rental car. His bike was destroyed, and he was sent flying.

“I remember it all. I remember flying through the air, my head smashing in the road, my helmet flying off,” he said.

“It shattered my femur bone. I had seven hours of surgery, blood transfusion, and now I’ve got to learn to walk again,” he said.

Alan Weymouth is seen in this undated image. (supplied)

Alan Weymouth is seen in this undated image. (supplied)

Toronto Police confirmed the driver, a youth, was charged criminally, and the car was a rental. The insurer of that car is Economical Insurance.

Weymouth was eventually discharged from hospital, unable to work, and needing constant care. He said he was briefly able to access attendant care, which is someone who does basic jobs around the home that he is no longer able to do, before the service was cut off.

“It’s absolutely not right and in Alan’s case it has hurt him significantly,” said Ben Fotia, Weymouth’s lawyer. “Basically his accidents benefits insurer has been trying [to] pay less than minimum wage for his housekeeping, home maintenance and care services since the accident.”

Fotia said it all comes down to rates. The provincial government guideline for attendant care, which was set in 2018, is $14.90 for routine personal care, $14.00 for basic supervisory functions, and $21.11 for complex health care and hygiene.

In Ontario’s no-fault system, insurers would typically pay these amounts quickly while any disputes would be resolved later in the courts.

In the past, insurers recognized the hourly amounts are low and allowed customers to pool the money from all approved hours to form a monthly total, which could then be paid to the caregiver to cover however many hours that money paid for at their rate, Fotia said.

But since a court decision in 2021, insurers have been more bold in demanding that the hourly rates they pay for match $14.00 or $14.90 — something that’s impossible given Ontario’s minimum wage is $15.50, Fotia said.

That approach, which was rarer last year, is becoming more common and has forced Anchor Rehabilitation Support Services to scale back its business, said its CEO Justin Kline.

“The insurance companies we were working with understood that it wasn’t a realistic rate to pay for PSWs [personal support workers],” he said, but that’s changed recently. The new approach could affect hundreds of people injured in car crashes across Ontario each year.

“There’s going to be a lot of people left without care or left with the option that they may have to pay for that care out of their settlement later down the road,” he said.

When approached by CTV News, Economical said it could not comment on Weymouth’s case, citing a need to protect his privacy.

Alan Weymouth is seen in this undated image. (supplied)

Alan Weymouth is seen in this undated image. (supplied)

“Economical is committed to delivering on its promise to be there for Canadians when they need us the most,” spokesperson Mathieu Genest said.

“Accident benefits are highly regulated with defined coverages and in many cases are intended to only partially cover certain costs. Economical pays benefits according to the accident benefits regime,” he said.

In a statement to CTV News, a spokesperson from Ontario’s insurance regulator, FSRA, said it would be “incorrect” to interpret Ontario’s rates as setting an hourly wage.

“An individual can choose to receive care from a provider charging any reasonable hourly rate, but their benefit will be capped at the maximum insurance limit,” the statement said. “Additionally, insurers are not prohibited from paying above the hourly rates provided in the guidelines.”

FSRA encouraged anyone facing this situation to submit a complaint.

CTVNews.ca Top Stories

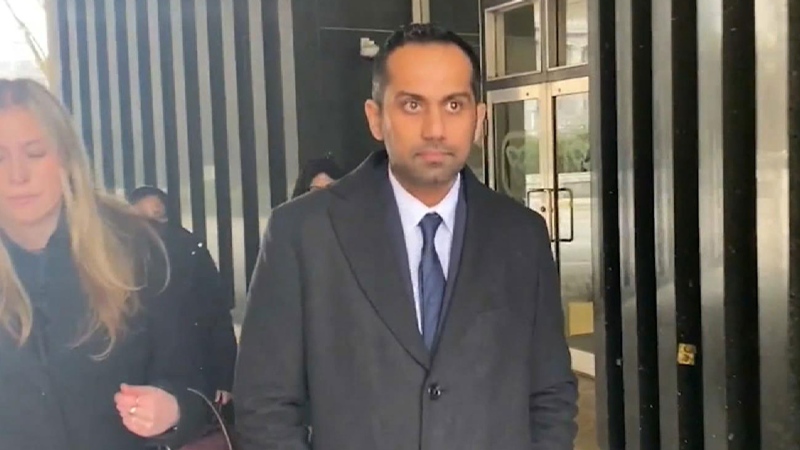

American millionaire Jonathan Lehrer denied bail after being charged with killing Canadian couple

American millionaire Jonathan Lehrer, one of two men charged in the killings of a Canadian couple in Dominica, has been denied bail.

Judge says 'no evidence fully supports' murder case against Umar Zameer as jury starts deliberations

The judge presiding over the trial of a man accused of fatally running over a Toronto police officer is telling jurors the possible verdicts they may reach based on the evidence in the case.

Nearly half of China's major cities are sinking, researchers say

Nearly half of China's major cities are suffering 'moderate to severe' levels of subsidence, putting millions at risk of flooding especially as sea levels rise.

LeBlanc says he plans to run in next election, under Trudeau's leadership

Cabinet minister Dominic LeBlanc says he plans to run in the next election as a candidate under Prime Minister Justin Trudeau's leadership, amid questions about his rumoured interest in succeeding his longtime friend for the top job.

Sports columnist apologizes for 'oafish' comments directed at Caitlin Clark. The controversy isn't over

A male columnist has apologized for a cringeworthy moment during former University of Iowa superstar and college basketball's highest scorer Caitlin Clark's first news conference as an Indiana Fever player.

Health Canada to change sperm donor screening rules for men who have sex with men

Health Canada will change its longstanding policy restricting gay and bisexual men from donating to sperm banks in Canada, CTV News has learned. The federal health agency has adopted a revised directive removing the ban on gay, bisexual and other men who have sex with men, effective May 8.

Prince Harry formally confirms he is now a U.S. resident

Prince Harry, the son of King Charles III and fifth in line to the British throne, has formally confirmed he is now a U.S. resident.

U.S. vetoes a widely supported UN resolution backing full membership for Palestine

The United States has vetoed a widely backed UN resolution that would have paved the way for full United Nations membership for the state of Palestine.

'Shopaholic' author Sophie Kinsella reveals brain cancer diagnosis

Sophie Kinsella, the best-selling author behind the 'Shopaholic' book series, has revealed that she is receiving treatment for brain cancer.