Ontario driver shocked after being told stolen vehicle won't be covered by insurance

An Ontario roofer who had his truck stolen out of his driveway two months ago was shocked when his insurance company said they wouldn’t cover the costs of a rental car.

Mississauga resident Damir Pogarcic called the initial theft “sad and scary,” but was relieved that his family was safe and that he had insurance.

Shortly after the theft, Pogarcic filed a claim with his insurance company, Aviva Canada, to replace his truck, a 2020 Ford F-150.

Pogarcic said he uses the truck to drive to customer's homes to give them quotes for roofing jobs.

"I do sales for the roofing business. I go and give prices and that's it,” he said Wednesday.

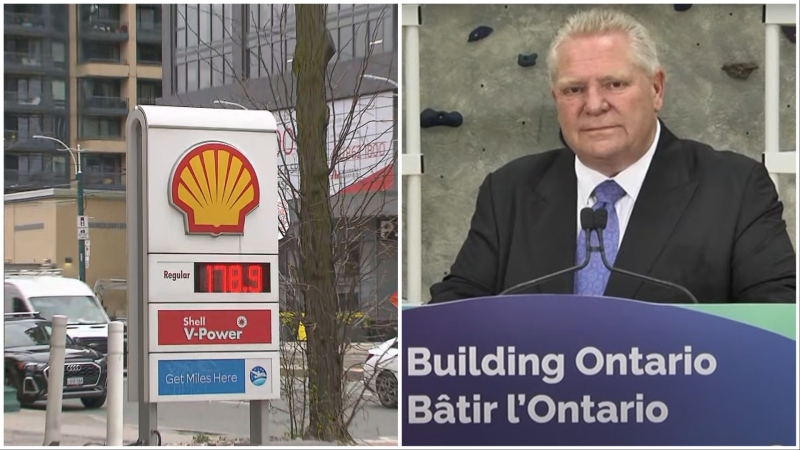

Pogarcic says he was originally given another truck as a rental, but when the insurance company found out the vehicle was being used for work, they halted payments on his rental and his case was immediately put under review.

His wife Alenka Pogarcic said she was under the impression their insurance policy did provide coverage because the policy contains the wording “vehicle used for business or business and pleasure.”

She wants Aviva to settle the claim and pay for their rental and replace their stolen pick-up truck.

“I'm saying that the vehicle needs to be paid off and replaced. It wasn't stolen on a construction site, it was stolen from our property. We have paid high insurance premiums and now we need them to pay us what we deserve,” Alenka said.

If you do use your vehicle for business purposes depending on your policy you may need to pay for additional commercial insurance and, if you don’t, an insurance company could deny your claim.

CTV News reached out to Aviva Canada and a spokesperson said “We are in the process of working with Mr. Damir Pogarcic on his claim and we do not discuss personal details of our customers’ insurance policies.”

“By way of a general comment, customers should be aware that insurance coverage for private vehicles are different from insurance coverage for commercial vehicles,” they said.

“It is important for customers to let their insurance advisors know how they are using their vehicles to ensure they have the correct coverage needed to be protected.”

The Pogarcic family is hopeful their case will be settled soon, but in the meantime, they are having to cover the cost of the rental, insurance payments and loan payments on the stolen truck.

"I have to go to work. I’m the only one making money for this family and I have two kids. I want to solve this problem and continue life,” Pogarcic said.

Drivers who use their vehicles for business purposes to make deliveries, for ride-sharing platforms, or for sales or marketing should know that they may require additional insurance.

Without it, they could have their claim denied if they're in an accident or their vehicle is stolen.

CTVNews.ca Top Stories

American millionaire Jonathan Lehrer denied bail after being charged with killing Canadian couple

American millionaire Jonathan Lehrer, one of two men charged in the killings of a Canadian couple in Dominica, has been denied bail.

Health Canada to change sperm donor screening rules for men who have sex with men

Health Canada will change its longstanding policy restricting gay and bisexual men from donating to sperm banks in Canada, CTV News has learned. The federal health agency has adopted a revised directive removing the ban on gay, bisexual and other men who have sex with men, effective May 8.

Nearly half of China's major cities are sinking, researchers say

Nearly half of China's major cities are suffering 'moderate to severe' levels of subsidence, putting millions at risk of flooding especially as sea levels rise.

Judge says 'no evidence fully supports' murder case against Umar Zameer as jury starts deliberations

The judge presiding over the trial of a man accused of fatally running over a Toronto police officer is telling jurors the possible verdicts they may reach based on the evidence in the case.

Sports columnist apologizes for 'oafish' comments directed at Caitlin Clark. The controversy isn't over

A male columnist has apologized for a cringeworthy moment during former University of Iowa superstar and college basketball's highest scorer Caitlin Clark's first news conference as an Indiana Fever player.

Prince Harry formally confirms he is now a U.S. resident

Prince Harry, the son of King Charles III and fifth in line to the British throne, has formally confirmed he is now a U.S. resident.

'Shopaholic' author Sophie Kinsella reveals brain cancer diagnosis

Sophie Kinsella, the best-selling author behind the 'Shopaholic' book series, has revealed that she is receiving treatment for brain cancer.

LeBlanc says he plans to run in next election, under Trudeau's leadership

Cabinet minister Dominic LeBlanc says he plans to run in the next election as a candidate under Prime Minister Justin Trudeau's leadership, amid questions about his rumoured interest in succeeding his longtime friend for the top job.

U.S. vetoes widely supported resolution backing full UN membership for Palestine

The United States vetoed a widely backed UN resolution Thursday that would have paved the way for full United Nations membership for Palestine, a goal the Palestinians have long sought and Israel has worked to prevent.