Ontario driver frustrated when car insurance goes up after postal code changed

An Ontario man said he was shocked when his auto insurance went up after Canada Post changed his postal code, but he didn’t actually move.

"It's frustrating beyond belief," said Dave Neale, who lives in a country property north of Orangeville, Ont.

Canada Post has changed postal codes over the years and that has led some insurance companies to increase their insurance premiums, but if you don't physically move, they're not supposed to.

Neale and his wife Aileen have four cars including a BMW Z3 and a Porsche Cayman S. In 2013, Canada Post changed their postal code from their country property address to one that includes downtown Orangeville.

"They now decided to sort our mail in a facility in Orangeville and as such my postal code represents the sorting facility, but my address is of course my house in the country," Neale explained.

Over the past eight years, Neale said he has been overcharged on auto insurance multiple times, most recently almost $300 on their Porsche.

And while he's been able to get the charges reversed in the past, he been told in the future he'll be charged based on the Orangeville postal code even though they never moved.

"Starting with my renewal, which would be in February of 2022, all my cars are going to be in Territory 22 or as I would say, the sorting facility," said Neale.

The Financial Services Regulatory Authority of Ontario (FSRA) oversees car insurance and says insurers are not allowed to use a new postal code to re-rate vehicles if the customer hasn't physically moved from their current address.

"FSRA is committed to strengthening consumer protection related to auto insurance by ensuring availability, enforcing regulatory oversight and achieving regulatory efficiency. We encourage consumers to reach out to FSRA if they have unresolved concerns about their auto insurance," a FSRA spokesperson told CTV News Toronto.

"With respect to auto insurance rating territories and postal code changes by Canada Post, the bulletin issued in 2006 still remains current. FSRA's expectation is that insurers are adjusting their systems to ensure that customers are being rated based on the territory they live in and not the territory their postal code puts them in. If errors do occur, it is the Insurer’s responsibility to ensure that the error is amended and that their customers are being treated fairly and being charged the correct premium."

Neale is insured with Intact Insurance and a spokesperson told CTV News Toronto, "At Intact, we work to ensure that automobile insurance meets the needs of customers. Automobile insurance premiums are based on a risk profile and usage that is determined by a combination of factors including type of vehicle and safety rating, driving record, mileage, where the car is driven, where you live, age of driver, type of coverage and the deductible."

"We encourage customers to work with their broker if they have questions or concerns about their premiums. Intact has been working closely with the customer and the customer’s broker to address their concerns," added the Intact spokesperson.

In the end, Neale was given a refund of almost $300 for his Porsche policy and now should not see increases on his other vehicle’s premiums moving forward.

Neale said everyone should know if your postal code changes, but you didn't move, there is no reason for your car insurance rates to go up and if they do you should complain and have them reduced to what they were before.

CTVNews.ca Top Stories

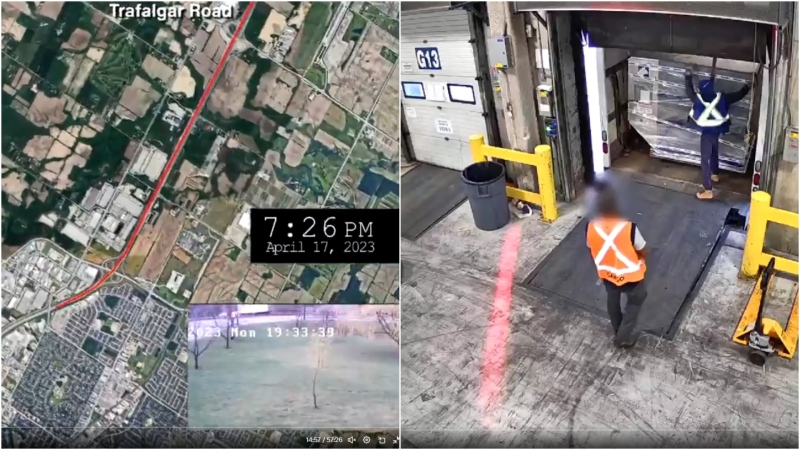

'They needed people inside Air Canada:' Police announce arrests in Pearson gold heist

Police say one former and one current employee of Air Canada are among the nine suspects that are facing charges in connection with the gold heist at Pearson International Airport last year.

House admonishes ArriveCan contractor in rare parliamentary show of power

MPs enacted an extraordinary, rarely used parliamentary power on Wednesday, summonsing an ArriveCan contractor to appear before the House of Commons where he was admonished publicly and forced to provide answers to the questions MPs said he'd previously evaded.

Leafs star Auston Matthews finishes season with 69 goals

Auston Matthews won't be joining the NHL's 70-goal club this season.

Trump lawyers say Stormy Daniels refused subpoena outside a Brooklyn bar, papers left 'at her feet'

Donald Trump's legal team says it tried serving Stormy Daniels a subpoena as she arrived for an event at a bar in Brooklyn last month, but the porn actor, who is expected to be a witness at the former president's criminal trial, refused to take it and walked away.

Why drivers in Eastern Canada could see big gas price spikes, and other Canadians won't

Drivers in Eastern Canada face a big increase in gas prices because of various factors, especially the higher cost of the summer blend, industry analysts say.

Doug Ford calls on Ontario Speaker to reverse Queen's Park keffiyeh ban

Ontario Premier Doug Ford is calling on Speaker Ted Arnott to reverse a ban on keffiyehs at Queen's Park, describing the move as “needlessly” divisive.

'A living nightmare': Winnipeg woman sentenced following campaign of harassment against man after online date

A Winnipeg woman was sentenced to house arrest after a single date with a man she met online culminated in her harassing him for years, and spurred false allegations which resulted in the innocent man being arrested three times.

Woman who pressured boyfriend to kill his ex in 2000s granted absences from prison

A woman who pressured her boyfriend into killing his teenage ex more than a decade ago will be allowed to leave prison for weeks at a time.

Customers disappointed after email listing $60K Tim Hortons prize sent in error

Several Tim Horton’s customers are feeling great disappointment after being told by the company that an email stating they won a boat worth nearly $60,000 was sent in error.