Ontario doctor shocked after finding more than $20,000 in Uber charges on credit card

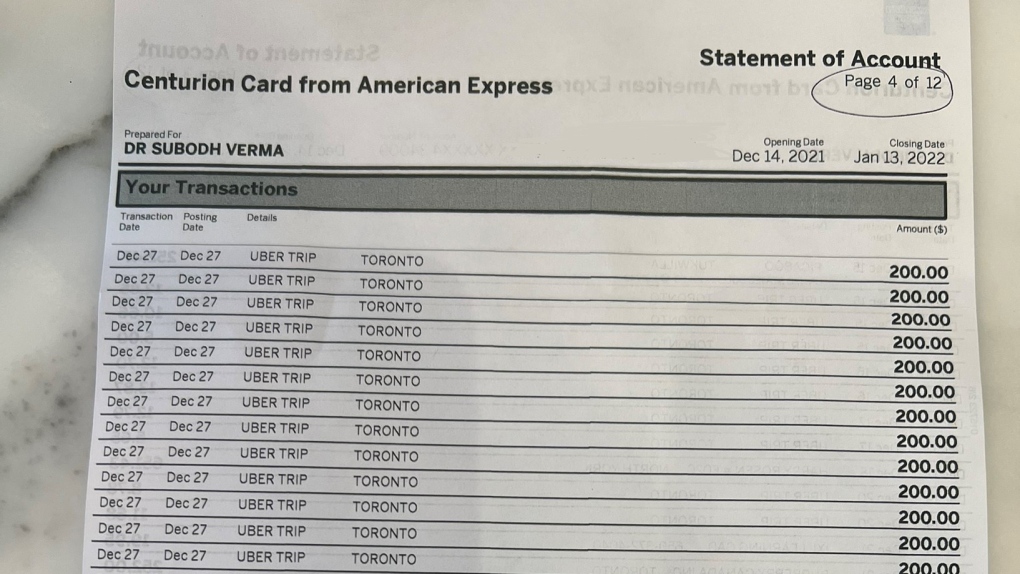

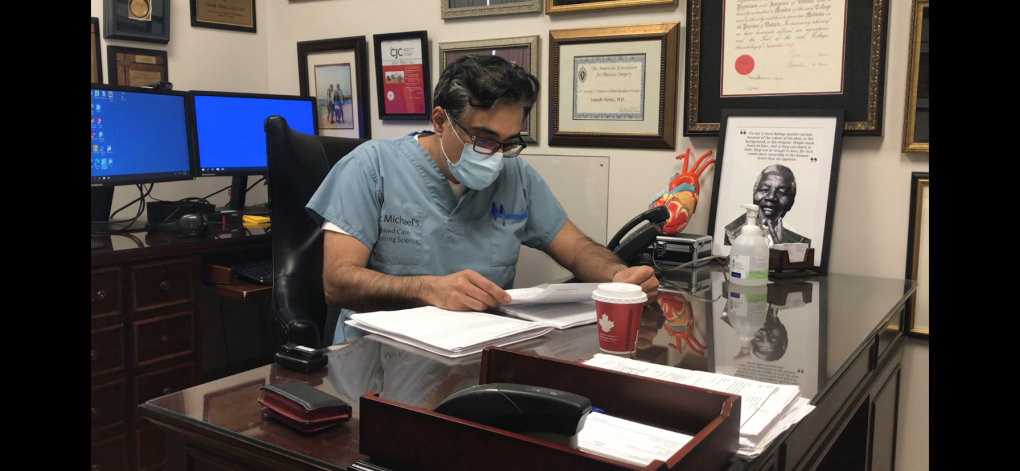

Toronto surgeon Dr. Subodh Verma didn’t expect to see more than $20,000 worth of Uber charges racked up when he looked at his latest credit card statement.

“When I opened the bill, I just saw the total amount,” Verma told CTV News, “and it shocked me.”

A $200 Uber charge stood out, considering he said most of his trips with the ride-sharing service only cost him a few dollars.

“It was clear there had been a case of fraud.”

The charge was from Dec. 27th and it was far from the only one.

The bill shows 103 separate charges for $200 each — all on the same day — totalling $20,600.

Statement of charges (Provided by Verma)

Statement of charges (Provided by Verma)

Verma says he was alerted by American Express that there had been fraudulent activity on his card and that his card would be cancelled.

“I thought that maybe there would be a $200 or $400 charge that went through, not that there would be a $20,000 charge that would go through.”

Verma says the frustration of the fraud was only made worse, when he tried to rectify it with American Express.

“The American Express Centurion fraud services alerted us that there was some fraud activity on Dec. 27th and that they were cancelling the card,” he said. “Yet, they’ve allowed the charges to go through.”

“Furthermore, when I spoke to them yesterday, they actually put the onus on me as the cardholder.”

He says American Express asked him to prove he wasn’t responsible for the charges.

Dr. Subodh Verma (Provided by Verma)

Dr. Subodh Verma (Provided by Verma)

Verma says he reached out to Uber about the issue, but didn’t receive much assistance.

“All we got back was a response that says ‘We’re sorry to hear that you’re having difficulties but we can’t find any record of these charges,’” he said.

CTV News reached out to both companies. In a statement, an Uber spokesperson said “what the rider experienced is frustrating and appears to be a result of a targeted scam by a third-party.”

“We are still investigating, but we are in the process of refunding the charges back to the credit card,” they said.

An American Express spokesperson told CTV News Toronto they were aware of the issue.

“If card members are a victim of fraud, have taken reasonable care to protect their account details and provide any necessary information to our fraud department, they will not be held responsible for any charges,” the company said.

It's the news Verma says he’d hoped to hear.

“All I needed to hear from them is ‘We’ve got it covered, we’re going to get to the bottom of it.”

Both companies said they planned to be in touch with Dr. Verma.

As for Verma, he says he plans to keep using both the ride-sharing service and the credit card company, but he hopes his experience will help both companies improve their customer service policies.

“We are not protected from fraud when it matters the most and sometimes these multi-billion dollar companies, such as Uber or American Express, fall short in assisting.”

CTVNews.ca Top Stories

'One of the single most terrifying things ever': Ontario couple among passengers on sinking tour boat in Dominican Republic

A Toronto couple are speaking out about their 'extremely dangerous' experience on board a sinking tour boat in the Dominican Republic last week.

Half of Canadians have negative opinion of latest Liberal budget: poll

A new poll suggests the Liberals have not won over voters with their latest budget, though there is broad support for their plan to build millions of homes.

opinion Why you should protect your investments by naming a trusted contact person

Appointing a trusted person to help with financial obligations can give you peace of mind. In his personal finance column for CTVNews.ca, Christopher Liew outlines the key benefits of naming a confidant to take over your financial responsibilities, if the need ever arises.

Teacher shortages see some Ontario high school students awarded perfect grades on midterm exams

Students at a high school in York Region have been awarded perfect marks on their midterm exams in three subjects – not because of their academic performances however, but because they had no teacher.

'My stomach dropped': Winnipeg man speaks out after being criminally harassed following single online date

A Winnipeg man said a single date gone wrong led to years of criminal harassment, false arrests, stress and depression.

Doctors combine a pig kidney transplant and a heart device in a bid to extend woman's life

Doctors have transplanted a pig kidney into a New Jersey woman who was near death, part of a dramatic pair of surgeries that also stabilized her failing heart.

Photographer alleges he was forced to watch Megan Thee Stallion have sex and was unfairly fired

A photographer who worked for Megan Thee Stallion said in a lawsuit filed Tuesday that he was forced to watch her have sex, was unfairly fired soon after and was abused as her employee.

Ottawa injects another $36M into vaccine injury compensation fund

The federal government has added $36.4 million to a program designed to support people who have been seriously injured or killed by vaccines since the end of 2020.

An Ontario senior thought he called Geek Squad for help with his printer. Instead, he got scammed out of $25,000

An Ontario senior’s attempt to get technical help online led him into a spoofing scam where he lost $25,000. Now, he’s sharing his story to warn others.