New Canadian mortgage 'stress test' rules take effect June 1

The Canadian real estate market has seen soaring prices, bidding wars and a lack of supply throughout the pandemic.

There is a concern some home buyers may be stretching their mortgage budgets to the max, which is why a new mortgage stress test will be coming into effect on June 1.

The new rules will reduce the buying power for some home buyers, protect people in the event that interest rates go up and potentially cool the Canadian housing market, which has seen record prices this year.

“Tomorrow, it gets harder to qualify for a mortgage for most people" according to Rob McLister, mortgage editor for RATESDOTCA .

For some Canadians looking to buy a home, they'll have less buying power when the new stress test rules take effect.

If you qualified for $500,000 under the current minimum qualifying rate of 4.79 per cent, that amount is reduced to $479,000 under the new qualifying rate of 5.25 per cent.

“So that increase in the minimum qualifying rate of 4.79 per cent is going to make it harder for people to get a mortgage who have a higher debt to income ratio" McLister said.

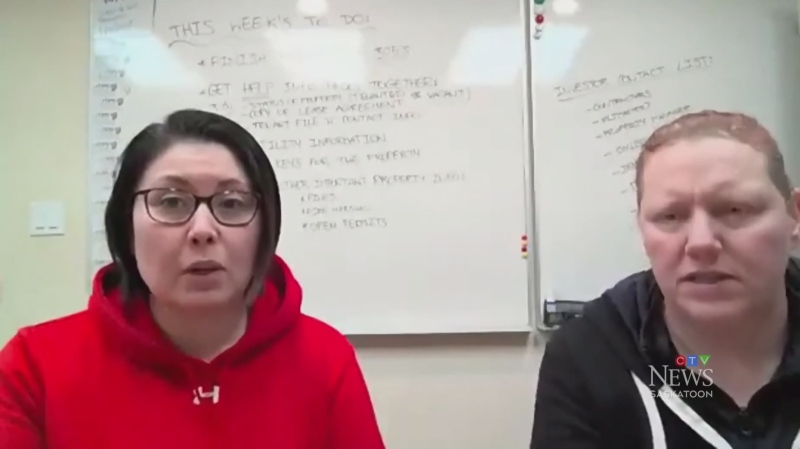

Leah Zlatkin, principal broker with Brite Mortgage, said the new rules could help some home buyers from taking on too much mortgage debt.

“The purpose of the stress test is to make sure people can afford things if interest rates go up," Zlatkin said.

Zlatkin said some of her clients were scrambling to find a home over the weekend before the new rules kicked in.

“I also did see a lot of clients reach out to get pre-approved before the new rules come into effect on June 1st" she said.

The change to mortgage rules may have the biggest impact on first-time homebuyers who have had to take part in bidding wars to get their dream home.

“I do think there are a number of Canadians who are saying, you know what, let’s just pause and let’s see if the stress test slows things down and maybe some of the prices will come down with it," Pattie Lovett-Reid, CTV’s Chief Financial Commentator, said.

Even with the new rules, there have been some signs the housing market is starting to slow down. The Canadian Real Estate Association reported the number of homes changing hands fell 12 per cent from March to April.

Even if the real estate market does slow down, no one is expecting huge price drops, but it could provide a more balanced market.

CTVNews.ca Top Stories

LIVE NOW Budget 2024 prioritizes housing while taxing highest earners, deficit projected at $39.8B

In an effort to level the playing field for young people, in the 2024 federal budget, the government is targeting Canada's highest earners with new taxes in order to help offset billions in new spending to enhance the country's housing supply and social supports.

From housing initiatives to a disability benefit, how the federal budget impacts you

From plans to boost new housing stock, encourage small businesses, and increase taxes on Canada’s top-earners, CTVNews.ca has sifted through the 416-page budget to find out what will make the biggest difference to your pocketbook.

BREAKING Police to announce arrests in Toronto Pearson airport gold heist

Police say that arrests have been made in connection with a $20-million gold heist at Toronto Pearson International Airport one year ago.

Proposed class-action lawsuit against Shoppers Drug Mart alleges 'unsafe and unethical corporate practices'

Shoppers Drug Mart is facing a proposed class-action lawsuit by current and former franchise owners at the retail chain who allege parent company Loblaw engaged in corporate practices that placed them in an “irredeemable conflict of interest” and put patient care at risk.

Lululemon unveils first summer kit for Canada's Olympic and Paralympic teams

Lululemon says it is combining function and fashion in its first-ever summer kit for Canada's Olympians and Paralympians.

Outdated cancer screening guidelines jeopardizing early detection, doctors say

A group of doctors say Canadian cancer screening guidelines set by a national task force are out-of-date and putting people at risk because their cancers aren't detected early enough.

Canada's health-care crisis was 'decades in the making,' says CMA

The strain placed on Canadian health care during the COVID-19 pandemic shows no sign of abating, and the top official of the Canadian Medical Association (CMA) is warning that improving the system will be a 'slow process' requiring sustained investment.

'I just started crying': Blue Jays player signs jersey for man in hospital

An Ontario woman says she never expected to be gifted a Blue Jays jersey for her ailing husband when she sat alone at the team’s home opener next to a couple of kind strangers.

Mussolini's wartime bunker opens to the public in Rome

After its last closure in 2021, it has now reopened for guided tours of the air raid shelter and the bunker. The complex now includes a multimedia exhibition about Rome during World War II, air raid systems for civilians, and the series of 51 Allied bombings that pummeled the city between July 1943 and May 1944.