Toronto home prices have fallen 'substantially,' RBC says. This is when they could bottom out

Activity in Toronto’s housing market appears to be levelling off following a sharp decline over the spring that saw home prices drop significantly.

But a new national report from RBC suggests that property values in the city and across Canada are still falling, albeit at a slower pace.

- Download our app to get local alerts on your device

- Get the latest local updates right to your inbox

“Nationwide, our view is that that benchmark prices will fall 14 per cent from peak to trough and probably a bit more in Ontario,” RBC Economist and report author Robert Hogue told CTV News Toronto in an interview.

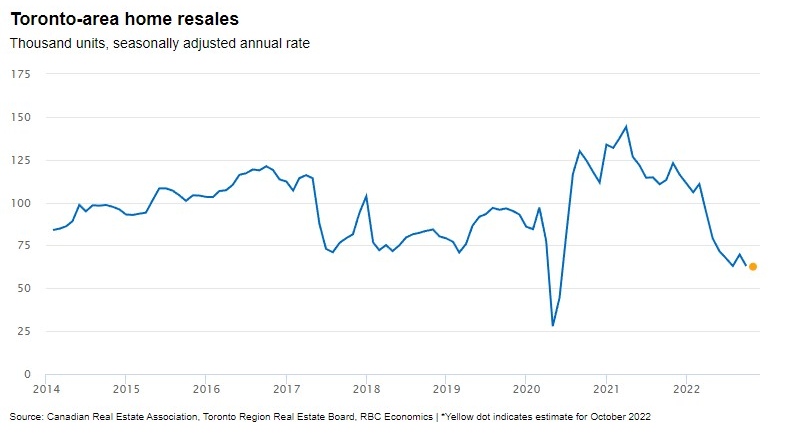

The data shows that activity in the Toronto area real estate market was generally flat from July to September with 63,000 to 69,700 resales taking place during that time. The report’s preliminary estimate for the month of October sits at 62,600.

Compared to the February peak that saw 110,800 resales, Hogue said Canada’s rising interest rates have “clearly” turned down the temperature on both demand and supply and the “excesses” of an overheated Toronto market are burning off.

“We're seeing that in prices that are coming down quite substantially, and will continue to do so,” Hogue said.

The Bank of Canada has raised interest rates six times already this year and is expected to announce another hike in December in an effort to fight inflation.

The Bank of Canada has raised interest rates six times already this year and is expected to announce another hike in December in an effort to fight inflation.

Since the first hike in March, the MLS’ Home Price Index (HMI), which Hogue describes as a “pure measure of a property’s value,” for the Toronto area has fallen 18 per cent

That means a home purchased in February is now worth roughly $230,000 less on average.

A for sale sign is shown in front of west-end Toronto homes Sunday, April 9, 2017. THE CANADIAN PRESS/Graeme Roy

A for sale sign is shown in front of west-end Toronto homes Sunday, April 9, 2017. THE CANADIAN PRESS/Graeme Roy

But when exactly will prices bottom out and could that be the time to get into the market as a first-time home buyer?

According to Hogue, spring 2023 will be time to watch as it could “open some doors” to buyers who have been waiting on the sidelines.

“At that point, we would expect to see affordability start to improve given, hopefully, by then, interest rates will have reached their peak and the big declines in prices will start to flow through better affordability,” he said.

“Downward pressure on prices will persist for the time being [in the Greater Toronto Area]. And, in our view, the way to alleviate, at least partly some of the affordability problem, is prices have to fall, so we have prices continuing to fall until the spring.”

At the same time, and despite interest rates being the highest they’ve been in more than a decade, Hogue’s report suggests the market hasn’t witnessed what he described as a “distressed selling wave.”

"Delinquency rates remain exceptionally low. And for sure, there is some tension building with higher rates, especially for those with variable mortgages, based on tremendous increase in the interest rates.

“This could potentially lead to trouble for some, but at this point, we're not seeing this,” he said.

Hogue went on to say the federal government’s stress test—a tool used to cool down an overheated housing market—will help prevent a “critical mass” of homeowners selling off.

The newest iteration of the stress test went into effect in June of 2021 and sees uninsured mortgages set at either the mortgage contract rate plus two per cent or 5.25 per cent (whichever is greater) in order to make sure a homeowner can afford to pay off their house.

CTVNews.ca Top Stories

Young people 'tortured' if stolen vehicle operations fail, Montreal police tell MPs

One day after a Montreal police officer fired gunshots at a suspect in a stolen vehicle, senior officers were telling parliamentarians that organized crime groups are recruiting people as young as 15 in the city to steal cars so that they can be shipped overseas.

'It was joy': Trapped B.C. orca calf eats seal meat, putting rescue on hold

A rescue operation for an orca calf trapped in a remote tidal lagoon off Vancouver Island has been put on hold after it started eating seal meat thrown in the water for what is believed to be the first time.

Man sets self on fire outside New York court where Trump trial underway

A man set himself on fire on Friday outside the New York courthouse where Donald Trump's historic hush-money trial was taking place as jury selection wrapped up, but officials said he did not appear to have been targeting Trump.

Sask. father found guilty of withholding daughter to prevent her from getting COVID-19 vaccine

Michael Gordon Jackson, a Saskatchewan man accused of abducting his daughter to prevent her from getting a COVID-19 vaccine, has been found guilty for contravention of a custody order.

Mandisa, Grammy award-winning 'American Idol' alum, dead at 47

Soulful gospel artist Mandisa, a Grammy-winning singer who got her start as a contestant on 'American Idol' in 2006, has died, according to a statement on her verified social media. She was 47.

She set out to find a husband in a year. Then she matched with a guy on a dating app on the other side of the world

Scottish comedian Samantha Hannah was working on a comedy show about finding a husband when Toby Hunter came into her life. What happened next surprised them both.

B.C. judge orders shared dog custody for exes who both 'clearly love Stella'

In a first-of-its-kind ruling, a B.C. judge has awarded a former couple joint custody of their dog.

Saskatoon police to search landfill for remains of woman missing since 2020

Saskatoon police say they will begin searching the city’s landfill for the remains of Mackenzie Lee Trottier, who has been missing for more than three years.

Shivering for health: The myths and truths of ice baths explained

In a climate of social media-endorsed wellness rituals, plunging into cold water has promised to aid muscle recovery, enhance mental health and support immune system function. But the evidence of such benefits sits on thin ice, according to researchers.