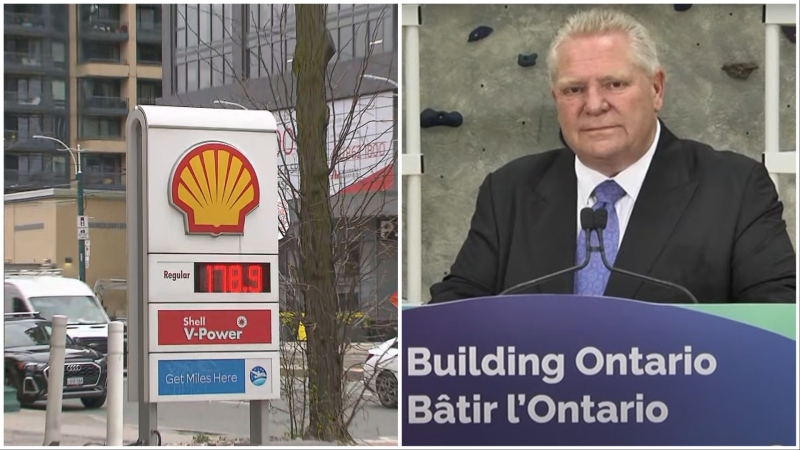

Inflation keeps going up. How do you protect yourself from rising prices?

As inflation rates accelerate at the fastest level in 30 years, people may be wondering how they can best protect their personal finances.

According to new data released by Statistics Canada on Wednesday, inflation was 4.8 per cent last month in Canada, up from 4.7 per cent in November. That pace hasn't been seen since September 1991.

In Ontario, inflation was even higher at 5.2 per cent.

CTV News Toronto asked Chief Financial Commentator Patricia Lovett-Reid what this means for people and how they can prepare for what’s ahead.

Lovett-Reid said the most immediate effect will likely be an increase in interest rates.

"It would be hard to find an economist on Bay Street that doesn’t think the bank isn't going to move at least 25 basis points next week," she said.

"We're paying more for just about everything. So, for the first time in a long time, we want the bank to raise interest rates to slow inflation down."

People wearing masks shop at a grocery store in Moncton, N.B., on Wednesday, September, 22, 2021. THE CANADIAN PRESS/Christopher Katsarov

People wearing masks shop at a grocery store in Moncton, N.B., on Wednesday, September, 22, 2021. THE CANADIAN PRESS/Christopher Katsarov

She said raising interest rates will lower people’s ability to spend, and in turn keep inflation rates in check.

"It reduces the purchasing power of people who have variable rate mortgages that are tied to the bank rate, because they have to put more money towards their mortgage,” Lovett-Reid said. “They have less to go out spending."

So what should you do?

Lovett-Reid suggests is people "do their homework" and explore the options with their mortgage.

She said it could be beneficial to "start thinking about moving into fixed-rate mortgages."

While Lovett-Reid said that won't be the solution for everyone, it't important to at least ask questions.

"I think you have proactive at this point," she said. "You don't want to become complacent."

CUT BACK ON SPENDING

Lovett-Reid said during times of high inflation it's important to understand where all your money is being spent and cutback on unnecessary goods.

She said people should ensure they know where each dollar they earn is spent and constantly ensure they're "getting the best bang for their buck."

She said a good example of inflation right now is streaming services. This week, Netflix announced it would be raising it's prices for users.

"They're small amounts, but incremental amounts add up to a lot of over the year," she said.

DON'T PANIC

Lovett-Reid said while the news headlines about inflation can seem scary for people, it's important to understand your own financial situation.

"I think the fact is that you have to understand where your household is at, and what your basket of goods really cost," she said. "For example, we saw inflation tick higher for cars, but you may not be in the market for a car."

She said people need to understand their needs "versus panicking from a headline number."

Overall, Lovett-Reid said there isn’t one single thing that will help save consumers money during this period of high inflation.

"It's going to be a series of doing a lot of little things," she said. "It's not about the big win."

CTVNews.ca Top Stories

BREAKING Israel attacks Iran, Reuters sources say; drones reported over Isfahan

Israel has attacked Iran, three people familiar with the matter told Reuters, as Iranian state media reported early on Friday that its forces had destroyed drones, days after Iran launched a retaliatory drone strike on Israel.

American millionaire Jonathan Lehrer denied bail after being charged with killing Canadian couple

American millionaire Jonathan Lehrer, one of two men charged in the killings of a Canadian couple in Dominica, has been denied bail.

Nearly half of China's major cities are sinking, researchers say

Nearly half of China's major cities are suffering 'moderate to severe' levels of subsidence, putting millions at risk of flooding especially as sea levels rise.

Prince Harry formally confirms he is now a U.S. resident

Prince Harry, the son of King Charles III and fifth in line to the British throne, has formally confirmed he is now a U.S. resident.

Judge says 'no evidence fully supports' murder case against Umar Zameer as jury starts deliberations

The judge presiding over the trial of a man accused of fatally running over a Toronto police officer is telling jurors the possible verdicts they may reach based on the evidence in the case.

Health Canada to change sperm donor screening rules for men who have sex with men

Health Canada will change its longstanding policy restricting gay and bisexual men from donating to sperm banks in Canada, CTV News has learned. The federal health agency has adopted a revised directive removing the ban on gay, bisexual and other men who have sex with men, effective May 8.

Colin Jost names one celebrity who is great at hosting 'Saturday Night Live'

Colin Jost, who co-anchors Saturday Night Live's 'Weekend Update,' revealed who he thinks is one of the best hosts on the show.

Sports columnist apologizes for 'oafish' comments directed at Caitlin Clark. The controversy isn't over

A male columnist has apologized for a cringeworthy moment during former University of Iowa superstar and college basketball's highest scorer Caitlin Clark's first news conference as an Indiana Fever player.

'Shopaholic' author Sophie Kinsella reveals brain cancer diagnosis

Sophie Kinsella, the best-selling author behind the 'Shopaholic' book series, has revealed that she is receiving treatment for brain cancer.