Many Canadians consider turning to part-time jobs if finances worsen, new survey says

A waitress relieving a credit card is seen in this file image. (Pexels)

A waitress relieving a credit card is seen in this file image. (Pexels)

A new Consumer Debt Report by the Canadian Counselling Society has found that many Canadians are pessimistic about their 2023 finances.

“It is no longer that it's a certain segment feeling the pinch, everyone is feeling the pinch" Anne Arbour, Director of Strategic Partnerships with the Credit Counselling Society, told CTV News Toronto.

82 per cent of Canadians surveyed said spending on essential goods is the main cause of their worsening finances and 63 per cent said they plan to make cutbacks to their expenses, especially on food.

"We all need groceries, we all need gas or bus money and those costs are going up. So it's not as simple as not taking a holiday, it has to do with buying the essentials that we all need," Arbour said.

The survey also found 42 per cent of those asked have experienced an increase in debt in the past year and that 35 per cent would consider getting a part-time job if things get worse.

For companies that deal with debt, this doesn’t come as a surprise – inflation is increasing and many people have not seen their income match those increases.

It’s being called a perfect storm of inflation, rising interest rates and incomes not keeping up, and it’s putting pressure on many families’ finances.

Many debt collection companies took a break from collecting during the pandemic, but have since resumed and now some are seeking repayment of debts, pushing some consumers into a precarious financial situation.

“Creditors are saying the pandemic is over and they want to collect what they are owed and some are being quite aggressive about it," Laurie Campbell, Director of Client Financial Wellness with Bromwich & Smith, a licenced insolvency trustee, said.

Campbell said that bankruptcies and consumer proposals are at their highest level since March 2020.

“We are seeing a steady increase in insolvencies and I predict over the next 6 to 12 months, the increases will continue," she said.

The survey also found, while many people have savings to fall back on if they need extra money, some consumers are forced to use credit cards, borrow from banks and other institutions and even ask friends and family.

Anyone feeling overwhelmed by their financial situation is urged to reach out for help.

"To understand you are not alone and there are resources out there whether it's a not-for-profit credit counselling agency or whether it's your financial institution or a trusted friend," Arbour said.

CTVNews.ca Top Stories

Senate expenses climbed to $7.2 million in 2023, up nearly 30%

Senators in Canada claimed $7.2 million in expenses in 2023, a nearly 30 per cent increase over the previous year.

Pedestrian, baby injured after stroller struck and dragged by vehicle in Squamish, B.C.

Police say a baby and a pedestrian suffered non-life-threatening injuries after a vehicle struck a baby stroller and dragged it for two blocks before stopping in Squamish, B.C.

Tom Mulcair: Park littered with trash after 'pilot project' is perfect symbol of Trudeau governance

Former NDP leader Tom Mulcair says that what's happening now in a trash-littered federal park in Quebec is a perfect metaphor for how the Trudeau government runs things.

'It's discriminatory': Individuals refused entry to Ontario legislature for wearing keffiyeh

Individuals being barred from entering Ontario’s legislature while wearing a keffiyeh say the garment is part of their cultural identity— and the only ones making it political are the politicians banning it.

RCMP uncovers alleged plot by 2 Montreal men to illegally sell drones, equipment to Libya

The RCMP says it has uncovered a plot by two men in Montreal to sell Chinese drones and military equipment to Libya illegally.

Government agrees to US$138.7M settlement over FBI's botching of Larry Nassar assault allegations

The U.S. Justice Department announced a US$138.7 million settlement Tuesday with more than 100 people who accused the FBI of grossly mishandling allegations of sexual assault against Larry Nassar in 2015 and 2016, a critical time gap that allowed the sports doctor to continue to prey on victims before his arrest.

Canucks goalie Thatcher Demko won't play in Game 2

The Vancouver Canucks will be without all-star goalie Thatcher Demko when they face the Nashville Predators in Game 2 of their first-round playoff series.

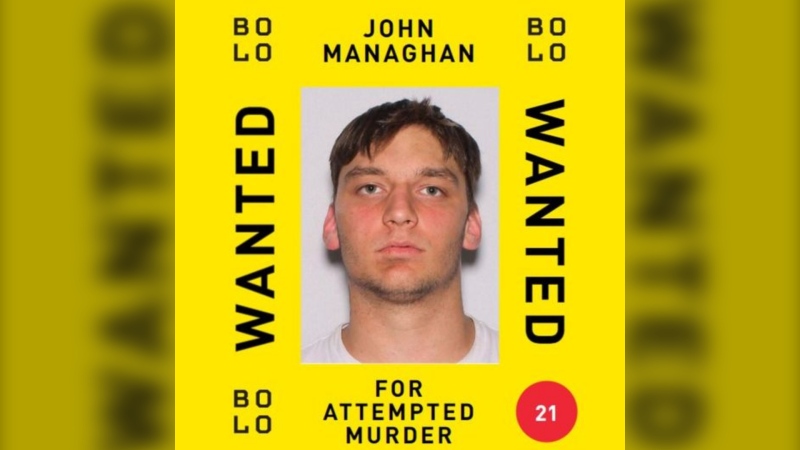

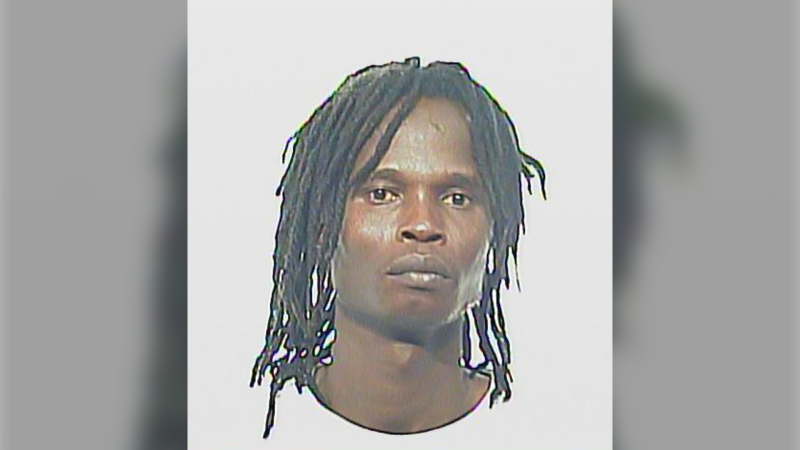

Man wanted in connection with deadly shooting in Toronto tops list of most wanted fugitives in Canada

A 35-year-old man wanted in connection with the murder of Toronto resident 29-year-old Sharmar Powell-Flowers nine months ago has topped the list of the BOLO program’s 25 most wanted fugitives across Canada, police announced Tuesday.

Doctors ask Liberal government to reconsider capital gains tax change

The Canadian Medical Association is asking the federal government to reconsider its proposed changes to capital gains taxation, arguing it will affect doctors' retirement savings.