Many Canadians consider turning to part-time jobs if finances worsen, new survey says

A waitress relieving a credit card is seen in this file image. (Pexels)

A waitress relieving a credit card is seen in this file image. (Pexels)

A new Consumer Debt Report by the Canadian Counselling Society has found that many Canadians are pessimistic about their 2023 finances.

“It is no longer that it's a certain segment feeling the pinch, everyone is feeling the pinch" Anne Arbour, Director of Strategic Partnerships with the Credit Counselling Society, told CTV News Toronto.

82 per cent of Canadians surveyed said spending on essential goods is the main cause of their worsening finances and 63 per cent said they plan to make cutbacks to their expenses, especially on food.

"We all need groceries, we all need gas or bus money and those costs are going up. So it's not as simple as not taking a holiday, it has to do with buying the essentials that we all need," Arbour said.

The survey also found 42 per cent of those asked have experienced an increase in debt in the past year and that 35 per cent would consider getting a part-time job if things get worse.

For companies that deal with debt, this doesn’t come as a surprise – inflation is increasing and many people have not seen their income match those increases.

It’s being called a perfect storm of inflation, rising interest rates and incomes not keeping up, and it’s putting pressure on many families’ finances.

Many debt collection companies took a break from collecting during the pandemic, but have since resumed and now some are seeking repayment of debts, pushing some consumers into a precarious financial situation.

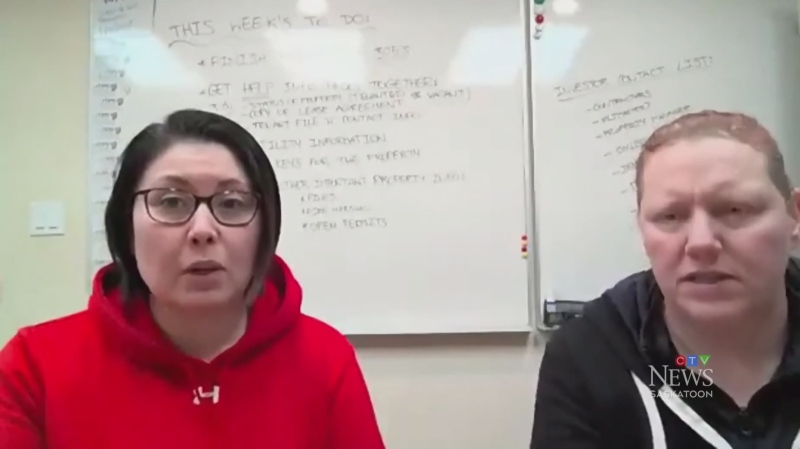

“Creditors are saying the pandemic is over and they want to collect what they are owed and some are being quite aggressive about it," Laurie Campbell, Director of Client Financial Wellness with Bromwich & Smith, a licenced insolvency trustee, said.

Campbell said that bankruptcies and consumer proposals are at their highest level since March 2020.

“We are seeing a steady increase in insolvencies and I predict over the next 6 to 12 months, the increases will continue," she said.

The survey also found, while many people have savings to fall back on if they need extra money, some consumers are forced to use credit cards, borrow from banks and other institutions and even ask friends and family.

Anyone feeling overwhelmed by their financial situation is urged to reach out for help.

"To understand you are not alone and there are resources out there whether it's a not-for-profit credit counselling agency or whether it's your financial institution or a trusted friend," Arbour said.

CTVNews.ca Top Stories

Outdated cancer screening guidelines jeopardizing early detection, doctors say

A group of doctors say Canadian cancer screening guidelines set by a national task force are out-of-date and putting people at risk because their cancers aren't detected early enough.

Lululemon unveils first summer kit for Canada's Olympic and Paralympic teams

Lululemon says it is combining function and fashion in its first-ever summer kit for Canada's Olympians and Paralympians.

'I just started crying': Blue Jays player signs jersey for man in hospital

An Ontario woman says she never expected to be gifted a Blue Jays jersey for her ailing husband when she sat alone at the team’s home opener next to a couple of kind strangers.

Mussolini's wartime bunker opens to the public in Rome

After its last closure in 2021, it has now reopened for guided tours of the air raid shelter and the bunker. The complex now includes a multimedia exhibition about Rome during World War II, air raid systems for civilians, and the series of 51 Allied bombings that pummeled the city between July 1943 and May 1944.

LIVE @ 4 EDT Freeland to present 2024 federal budget, promising billions in new spending

Canadians will learn Tuesday the entirety of the federal Liberal government's new spending plans, and how they intend to pay for them, when Deputy Prime Minister and Finance Minister Chrystia Freeland tables the 2024 federal budget.

B.C. woman facing steep medical bills, uncertain future after Thailand crash

The family of a Victoria, B.C., woman who was seriously injured in an accident in Thailand is pleading for help as medical bills pile up.

Step inside 'The Brain': Northern education tool aims to promote drug safety

An immersive experience inside a massive dome coined 'The Brain' is helping youth learn about brain function and addiction

WATCH Half of Canadians living paycheque-to-paycheque: Equifax

As Canadians deal with a crushing housing shortage, high rental prices and inflationary price pressures, now Equifax Canada is warning that Canadian consumers are increasingly under stress"from the surging cost of living.

Ontario woman charged almost $7,000 for 20-minute taxi ride abroad

An Ontario woman was shocked to find she’d been charged nearly $7,000 after unknowingly using an unauthorized taxi company while on vacation in January.