TORONTO -- Due to COVID-19, more people are ordering from food delivery services and that means more people are also working as food delivery drivers.

A North York man lost his job due to the pandemic and decided to make extra money working as a delivery driver for Uber Eats.

When his SUV was stolen out of his driveway last month, his insurance claim was denied.

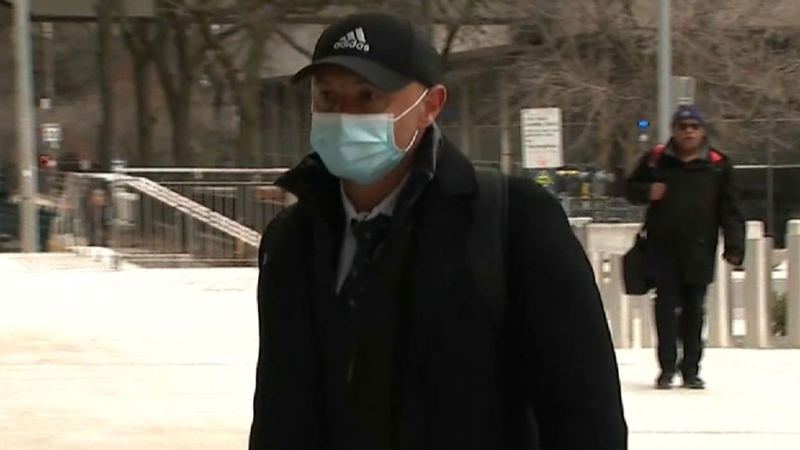

Long Chen said he didn’t know his 2020 Lexus RX 350 was a target for thieves and in mid-January his SUV was stolen from in front of his home.

“It was stolen out of my driveway while I was asleep. I even have security video to show them it was a thief and not my fault," said Chen.

The luxury SUV has been a target for thieves and can be stolen with high tech equipment without the vehicle’s keys.

When the vehicle was stolen Chen said he told his insurance company he occasionally drives for Uber Eats and that’s when he says his claim was denied.

“I didn't know that working for Uber Eats would affect my insurance” Chen said. "If they deny my claim I lose my credit, I lose my hope for the future because I have no income and I’m still looking for a job. I need my car.”

CTV News contacted Uber Eats and we were told that drivers need to inform their insurance company if they're working as a food delivery driver.

Uber Eats said it maintains commercial auto insurance to help protect drivers, if they're in an accident while making a delivery for Uber, but in Chen’s case he wasn’t working when the car was stolen.

Chen’s insurance company is the Co-operators. When CTV News reached out, initially a spokesperson for the Co-operators said “we are looking into the matter and are unable to comment further.”

But later the company said in a statement that, “striking the right balance on insurance for food delivery drivers has been something we have been reviewing."

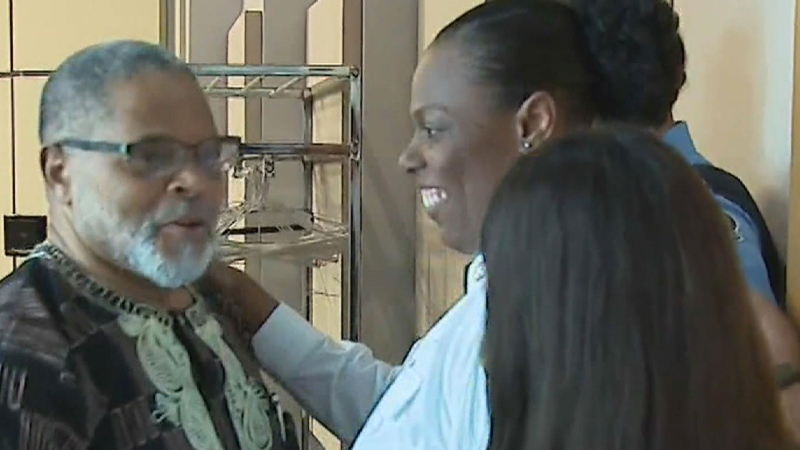

"We are pleased to let you know that we have reviewed Mr. Chen’s claim and we will be providing coverage.”

Chen's SUV was recovered by police in Montreal and now all costs related to the theft, damages and his car rental will be covered by the Co-operators insurance company.

That was a relief for Chen.

“I feel like finally the burden on my shoulders has been released. Without the help of CTV I don't think they would have helped me because they had given me their final position," he said.

Uber’s insurance policy is valid only when the Uber app is turned on. When it's turned off your personal car insurance kicks in.

If you're working as a food delivery driver or with a ride sharing service and have questions or concerns you should contact your insurance company for more information.