Drug and money laundering investigation 'Operation Mad Money' has links to GTA real estate, documents show

A drug and money laundering investigation called "Operation Mad Money—which stretched from Toronto to British Columbia to China—has shown links between illegal marijuana sales and Toronto’s booming real estate market, CTV News Toronto has learned.

The investigation, led by the Calgary Police Service, is part of an attempt to seize millions in what authorities allege are drug profits that ended up in money service businesses in the Greater Toronto Area, who passed them along to people trying to buy homes.

And it could be the tip of the iceberg, says one retired Royal Canadian Mounted Police officer and money laundering expert. In an interview, Garry Clement says Ontario should follow in the footsteps of B.C. and call a public inquiry to assess how big an impact laundered money has in the property market.

“We know that this is going on, we know money is coming into the province. All you do is look at the number of condos that are sitting vacant,” Clement said.

“Canada really needs to sit down and realize we are still a very weak link. This case demonstrates that we have a long way to go."

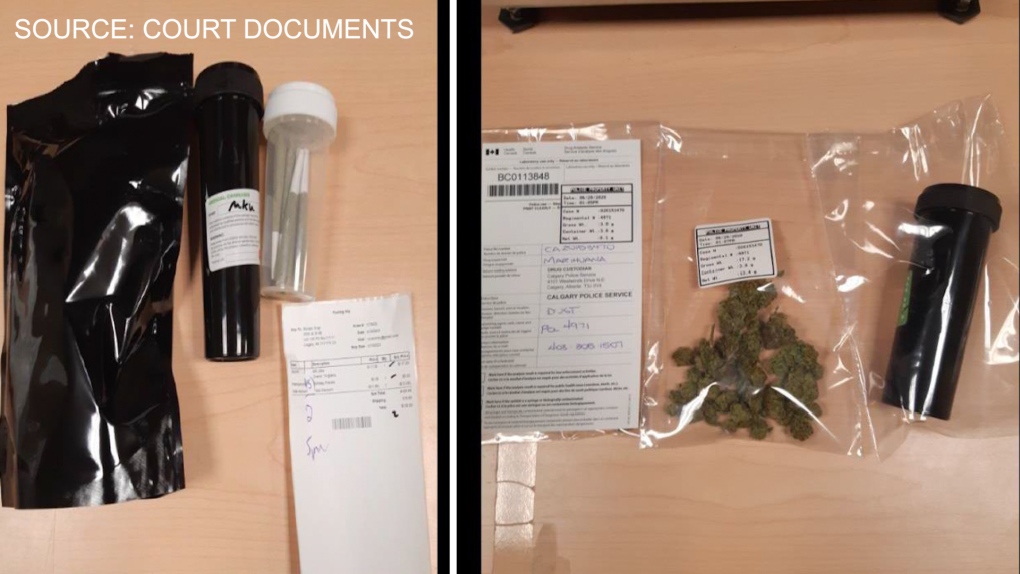

The investigation started with a Calgary police officer buying marijuana from websites called BudExpressNow and Cheapweed, a motion filed in Ontario Superior Court says.

The Calgary police made several purchases of marijuana in their investigation of an online retailer they allege is connected to real estate purchases in the Greater Toronto Area

The Calgary police made several purchases of marijuana in their investigation of an online retailer they allege is connected to real estate purchases in the Greater Toronto Area

Court documents claim the sites didn’t have a licence to sell, and an investigation showed they did more than $3 million in business through multiple feeder accounts, accepting electronic bank transfers with explanatory notes including “weedguy” and “ed and bills.”

Police watched money get deposited in bank accounts in Edmonton, and tracked some of that to three properties outside Vancouver, where they say it was used to pay $1.38 million in electricity bills.

The properties did have Health Canada licenses to grow about 5,000 marijuana plans, but a police raid in 2020 counted almost four times as many.

B.C.’s OffIice of Civil Forfeiture is applying to seize those properties.

In Ontario, authorities claim in documents filed in Superior Court that the alleged profits of the operation ended up in the control of Toronto-area money service businesses, which authorities say sent money in Canada to Chinese nationals interested in buying Toronto real estate.

In exchange, the Chinese nationals repaid the money in China, the documents say, pointing out that this is a way to circumvent currency controls in China that prevent money from easily being withdrawn from that country.

Ontario’s Attorney General is now applying to seize some $3.7 million in bank accounts it says contain money from the marijuana sales.

"The pattern of deposits into the subject accounts, including the frequent, large deposits made in round numbers, is indicative of unlawful activity," the court application says.

"The contents of the respondent accounts are made up in whole or in part by proceeds of illegal online cannabis sales and/or are instruments of money laundering."

The allegations are in civil court, which rely on a lower standard of proof than criminal court. Nothing has been proven and a judge is weighing the case now.

One lawyer for the recipients of the money told a recent court hearing they believed everything was legal and had no idea that the money deposited in their accounts could have come from unlicensed marijuana.

“The respondents were not in any way involved in the alleged unlawful acts that were apparently committed by unknown perpetrators,” said lawyer William E. Peppall.

"This is not a case of a delinquent individual, a felon, nor a criminal mastermind. The respondents are innocent bystanders who purchased for legitimate reasons Canadian currency at fair market value in exchange for their Canadian currency that was earned through legal means," he said.

Clement, the money laundering expert, says the alleged arrangement has a lot in common with a scheme in B.C. where drug money was laundered through government-licensed casinos, and poured into real estate — so much that a government report found it was responsible for a five per cent surge in prices.

The B.C. government called a public inquiry known as the Cullen Commission. Clement said a public inquiry may be necessary in Ontario too.

“This shows we have a lot of gaps in our system,” he said.

FINTRAC, the federal agency which tracks money laundering, says it’s conducted 276 examinations in the past three years, and 700 real estate transactions in the last five years.

The agency says it’s issued nine notices of violation for non-compliance, five in the real estate sector for $143,219, two in money services for $143,219, and two in the dealers of precious metals and stones for a total of $272,910.

The agency said the money service business identified in the court case is registered, but it could not share anything it would have disclosed to police about the case.

The Department of Finance told CTV News Toronto in a statement it had invested $98.9 million over five years to enhance the RCMP and strengthen its foundations to help fight money laundering and identify proceeds of crime.

“New integrated money laundering investigative teams (IMLITs) will be created in British Columbia, Alberta, Ontario and Quebec, bringing together expertise from a variety of agencies to address high profile cases and advance money laundering and proceeds of crime investigations nation-wide,” a spokesperson said.

CTVNews.ca Top Stories

B.C. child killer's lawyer walks out of review hearing

The lawyer representing child-killer Allan Schoenborn walked out of his client's annual review hearing Wednesday – abruptly ending proceedings marked by tense exchanges and several outbursts.

Why drivers in Ontario, Quebec and Atlantic Canada will see a gas price spike, and other Canadians won't

Drivers in Eastern Canada face a big increase in gas prices because of various factors, especially the higher cost of the summer blend, industry analysts say.

'A living nightmare': Winnipeg woman sentenced following campaign of harassment against man after online date

A Winnipeg woman was sentenced to house arrest after a single date with a man she met online culminated in her harassing him for years, and spurred false allegations which resulted in the innocent man being arrested three times.

How to avoid the trap of becoming 'house poor'

The journey to home ownership can be exciting, but personal finance columnist Christopher Liew warns about the trappings of becoming 'house poor' -- where an overwhelming portion of your income is devoured by housing costs. Liew offers some practical strategies to maintain better financial health while owning a home.

It's the biggest election in history. Here's why few Indians in Canada will take part

In the Indian general election that gets underway on Friday, almost a billion people are eligible to vote, but a vast majority of the overseas Indian community in Canada won't be casting a ballot.

McDonald's customers left with 'zero value' collection of free hot drink stickers after company ends program

It took years for Vinnie Deluca to collect more than 400 cards worth of free McDonald's McCafe coffee, a collection that now has "zero value" after the company discontinued the program.

Juror dismissed in Trump hush money trial as prosecutors ask for former president to face contempt

Prosecutors in the hush money trial of Donald Trump asked Thursday for the former president to be held in contempt and fined because of seven social media posts that they said violated a judge's gag order barring him from attacking witnesses.

Toxic forever chemicals in drinking water: Is Canada doing enough?

As the United States sets its first national limits on toxic forever chemicals in drinking water, researchers say Canada is lagging when it comes to regulations.

Where did the gold go? Crime expert weighs in on unfolding Pearson airport heist investigation

Almost 7,000 bars of pure gold were stolen from Pearson International Airport exactly one year ago during an elaborate heist, but so far only a tiny fraction of that stolen loot has been found.