TORONTO -- Canada's big banks offered payment deferral plans last year for mortgages, loans and credit cards, but now that those programs have ended some have started raising their service charges.

“Why are they squeezing the little guy in arguably one of the worst times we have seen in a long time," said Todd Robinson of Springwater, Ont.

Robinson has banked with TD most of his life and said he was shocked to get a letter last month showing banking fees for his preferred chequing account were set to increase.

Instead of keeping $2,000 in his account to avoid transaction fees of $1.25, he will now have to keep $5,000 in his account at all times or each transaction fee will cost him $1.95.

“I suspect it would be $20 or $30 dollars worth I would be paying if I don't keep that minimum balance," said Robinson.

“I think it’s outrageous,” said Krystyna of Toronto who asked her last name not be used. She added, “My concerns are two fold. It's an outrageous amount and it's very poor timing."

CTV News Toronto asked TD Bank Group about the changes and a spokesperson said “While the majority of Preferred Chequing Account holders are not impacted by the increase in the minimum monthly balance, this decision is never made lightly and only occurs after careful consideration and review.”

The TD spokesperson added, “We understand that pricing changes can be a delicate issue and we encourage customers with concerns or questions to talk to us about the chequing accounts they hold and the options we have available.”

The increase in fees at TD come at a time when other banks are also raising some of their fees for products and services.

CIBC, Scotiabank and Bank of Montreal have already raised some fees for their services in 2021 or plan to do so before the summer.

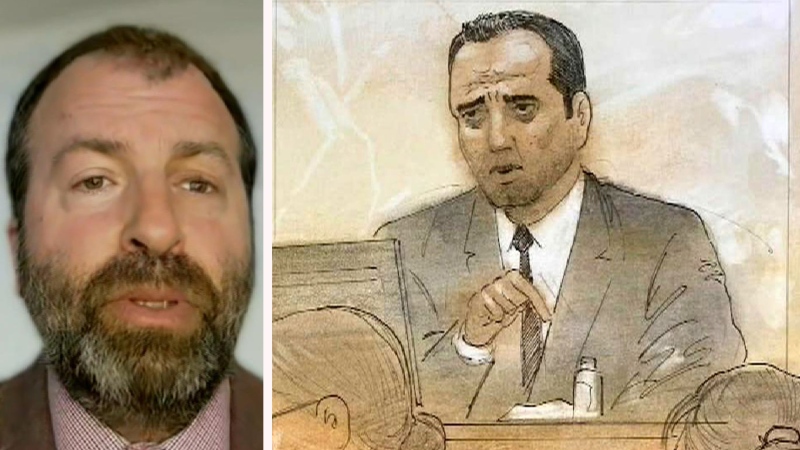

"Four of Canada’s six big banks were among the most profitable banks in the world in the top 50 in 2020," said Duff Conacher, co-founder of Democracy Watch, a group that advocates for government accountability and corporate responsibility.

Conacher said Democracy Watch has a petition with almost 80,000 signatures calling for Canadians banks to do more during the pandemic to help Canadians as well as after.

More than 30,000 similar messages have also been sent to politicians calling on banks to cut their fees and interest rates on some products.

“Now they are back at it, gouging their way to record profits in 2021 and the government should step in and stop the excessive gouging that is clear with so many bank service fees and interest rates,” said Conacher.

Conacher said Canadians are paying some of the highest fees in the world as well as credit card interest rates. He said banks should be audited to see if they have areas where their profits are excessive so they can be reduced.

“It's just a clear sign that it's an uncompetitive market that needs to be regulated," said Conacher.

No matter where you bank, it's a good idea to review the fees and services charges you pay each month as you may find there is a better banking package that can reduce fees and save you money.