TORONTO - Ontario's busy Highway 407 Express Toll Route could soon have another Canadian owner after one of the country's largest pension funds bid on the Australian firm that owns a 30 per cent stake in the highway.

The Canada Pension Plan Investment Board has made a non-binding $3.2-billion proposal to acquire Australia's Intoll Group (ASX:ITO), an offer that implies an enterprise value for the company of A$5.1 billion, including debt assumed by the pension plan.

The pension fund is particularly interested in holding the assets of a Canadian toll operator, and believes its familiarity with the country's traffic patterns, GDP growth, and population growth will make it a good fit.

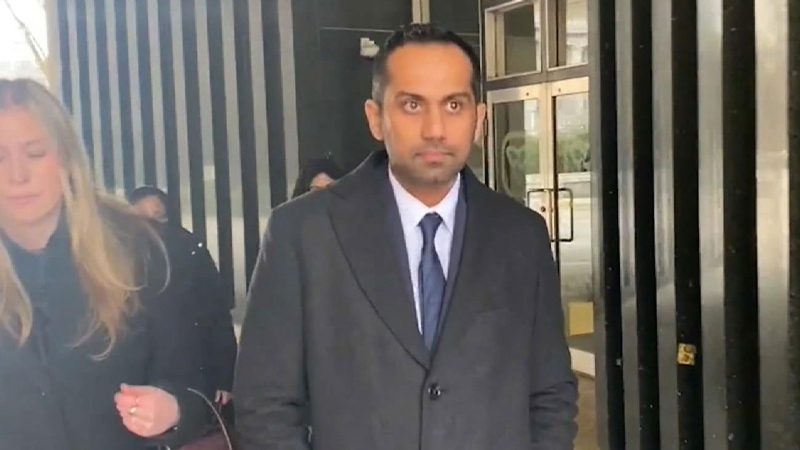

"The asset being in Canada was obviously an advantage for us," Andre Bourbonnais, senior vice-president of private investments for the fund manager, said in an interview Thursday.

Intoll also owns a 25 per cent stake in Sydney, Australia's Westlink M7 toll highway.

CPPIB likes infrastructure assets because they have a predictable cash flow, offer inflation protection and are easy to maintain, Bourbonnais said. The board set up an infrastructure research group to examine potential opportunities in 2005.

"Toll roads were identified fairly early in our strategy discussion as an interesting asset that met all the characteristics," Bourbonnais explained.

"The 407 and M7 came out on our radar screen."

The conditional offer marks the Toronto-based fund manager's second attempt to purchase an Australian toll road operator, following a failed C$3.8-billion bid by the fund and its partners to take over Transurban Group (ASX:TCL) in May.

That bidding group also included the Ontario Teachers' Pension Plan and Sydney-based CP2 Ltd., which together held 40 per cent of Transurban's securities.

While Teachers has dumped the majority of its shares in Transurban since then, CPPIB has held onto its 13 per cent stake.

Bourbonnais said that despite its recent acquisition attempts, the fund isn't specifically targeting Australian toll road companies.

"There's certain jurisdictions that are easier for private ownership of infrastructure assets ... Australia happens to be one of them," he said.

CPPIB's offer includes C$1.186 cash and 23 Australian cents for each share, which represents a 38 per cent premium over Intoll's closing price on Monday and a 41.7 per cent premium on the average price for the preceding month.

It also offers an "unlisted rollover alternative" that allows Intoll shareholders to retain all or part of their current interest in the company.

The proposed transaction is subject to completion of due diligence and requires Intoll directors to unanimously recommend shareholders vote in favour of the deal in the absence of a superior transaction. CPPIB expects to make a formal bid in a matter of weeks.

However, the fund manager was reluctant to say whether it would raise its offer if other competing bids emerged, as it did several times after Transurban's rejections.

"Past transactions, especially in Australia, have demonstrated that we are a very disciplined bidder. We have done our analysis we put a proposal on the table that clearly in our mind fully values the asset," Bourbonnais said.

"If it works, it works. If it doesn't, we look for another asset."

Intoll was spun off from Aussie fund management giant Macquarie Group to manage the Canadian and Australian toll road assets. If the acquisition is successful, it would become CPPIB's largest single investment.

Infrastructure currently makes up under 10 per cent of the CPPIB's assets, but Bourbonnais said the board continues to scour the world for opportunities to expand its infrastructure portfolio.

The bid is good news for Montreal-based engineering company SNC-Lavalin (TSX:SNC) because it would boost the value of its 16.77 per cent stake in the toll road.

Desjardins Securities analyst Pierre Lacroix upgraded his target price for SNC-Lavalin to $59 from $57, while shares in SNC-Lavalin gained 77 cents to $45.30 Thursday on the Toronto Stock Exchange.

The transaction implies a $10.50-per-share value for SNC's stake in Highway 407, up from Lacroix's previous estimate of $8.50.

Highway 407 stretches 108 kilometres from the Queen Elizabeth Way near Burlington on a northeastern path that skirts Toronto and reaches Pickering in the east.

The highway has become an important part of the province's system for moving goods and people from its industrial heartland in the Toronto area to the U.S. border near Niagara Falls.

It is one of Ontario's few privately owned highways and the only toll highway in Canada that operates electronically and without any collection booths.

The remaining 53 per cent stake in the 407 highway company is owned by Spain's Ferrovial.

407 International Inc., the consortium that owns the highway, announced improved second quarter results Thursday, with earnings more than four times what they were in the year-earlier period.

The company reported net income of $33.6 million compared with $8 million for the same period of 2009. Revenues were $162 million, up from $142.1 million last year.

About 29.8 million drivers travelled the highway during the second quarter, compared to 28.2 million last year. Nearly 400,000 used the highway on an average workday during the quarter.

The CPPIB is a professional investment management organization that invests the funds not needed by the Canada Pension Plan to pay current benefits on behalf of 17 million Canadian contributors and beneficiaries.

In order to build a diversified portfolio, the CPPIB invests in public equities, private equities, real estate, inflation-linked bonds, infrastructure and fixed-income instruments.

Many Canadian pension funds have invested heavily in infrastructure such as airports, power plants and ports around the world.